The Dividend Hunter recommended portfolio includes a range of different types of securities. Business Development Companies (BDCs) are one of them, and Owl Rock Capital Corp (ORCC) is one of my favorites, explains Tim Plaehn, editor of The Dividend Hunter.

Here are the types of securities we own, as well as a listing showing the features of each of our investments:

Common Stock Shares: With common shares, you are a partial owner of the business that issued the stock. The share price will reflect investors’ beliefs about the company. The board of directors will declare the dividend rate. Dividend payments depend on the cash flow generated by the company.

Preferred Stock Shares: Preferred shares pay a fixed dividend rate that will not change. Preferred dividends have “preference” over common share dividends, which means that if the company pays a common dividend, the preferred dividends are 100% safe.

Exchange-Traded Funds: ETF shares represent an ownership stake in a portfolio of securities. ETF shares work like mutual fund shares, except they trade on a stock exchange. An ETF sponsor will issue and redeem shares with institutional clients. This feature ensures that ETF shares trade close to the NAV value.

Closed-End Funds: CEFs also operate like mutual funds whose shares trade on the stock exchange. The difference is that a CEF sponsor does not issue or redeem shares. As a result, a CEF can trade at a significant premium or discount to the net asset value, or NAV.

On a related note: NAV for a fund will be the total portfolio value divided by the shares outstanding. Put another way; it’s the cash value per share if the entire portfolio would be liquidated.

As for BDCs, they thrive in this higher interest rate environment. A BDC makes adjustable-rate loans to its client companies but carries very low leverage itself. As a result, as rates rise, net income for a BDC grows nicely.

Owl Rock Capital Corp. (ORCC)

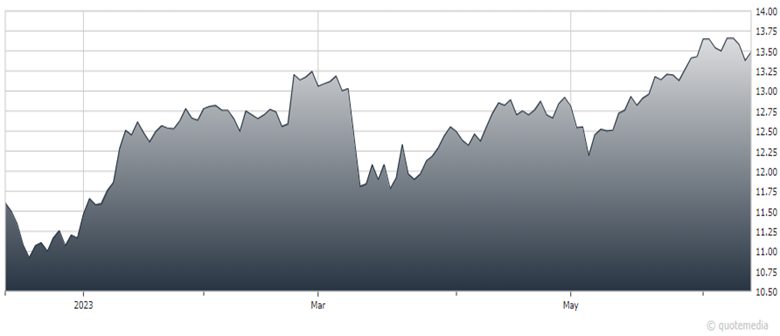

ORCC is one of the larger BDCs, with a $13 billion investment portfolio and a $5.3 billion market cap. For the 2023 first quarter, ORCC reported net investment income of $0.45 per share, up from $0.41 for the 2022 fourth quarter. The company declared a $0.33 regular dividend plus $0.06 in supplemental dividends.

As of the first quarter, ORCC had a book value of $15.15 per share (also growing). If the market had its head on straight, ORCC would trade above book value. However, that is not the case with the stock recently at $13.52. The yield based on the regular dividend was recently 9.7%. Now that the stock market has started to recover, ORCC should continue to rise until it is above $15.00 per share.

Recommended Action: Buy ORCC.