The most eagerly awaited Fed meeting since...well, the last one...has come and gone with precisely the result that was expected. But the bottom line for now is that inflation is still more than double where the Fed wants it, and they’ve blinked on rate hikes. This is a much more conducive environment for gold and silver, explains Brien Lundin, editor of Gold Newsletter.

The meeting expectations were guided, of course, by Fed whispers in advance, which they’re always careful to do to avoid nasty surprise reactions by the markets.

Intentions aside, while Powell and his cronies paused on rate hikes as expected, they did manage to surprise investors a bit with their hawkish rhetoric. Call it walking the dovish walk at the same time they’re talking the hawkish talk.

The dot plots showed 16 out of 18 officials expect between one and two quarter-point rate hikes still this year, with only two expecting rates to hold steady. In his post-meeting news conference, Chairman Jerome Powell seemed to echo this more-hawkish stance.

Considering how the Fed likes to manage expectations, it will take some significant data points to avoid a quarter-point hike next month. So, the market reaction was, as one might expect, mixed.

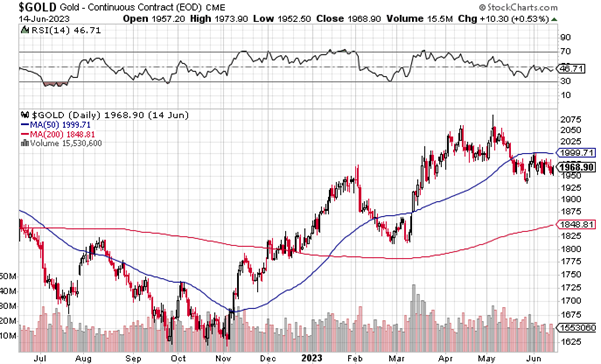

Gold Futures

Although the Fed is trying to walk a tight-rope with both its actions and rhetoric, a not-insignificant contingent of investors fully expect the Fed to cut rates before the end of the year.

Now that the pause is behind us, we’ll see more focus on when that pivot comes. While a recession is expected this fall, it seems doubtful that the Fed will pivot on the basis of early signs of an economic deceleration that, in fact, was their very goal.

So, forecasts of rate cuts are, in my view, predicting some sort of a market crack-up or financial crisis. We’ll see.

With summer now in full swing, seasonality is working against the bulls in metals and miners. That gives us time to accumulate some outstanding values in the junior mining sector.