Our time to be aggressive in risk-based assets will come. When it does, we will load up on closed-end funds that own small-cap value stocks, real estate investment trusts, international stocks, more high-yield bonds, convertible bonds, and other bargain-priced assets. For now, stick with things like The Nuveen California Quality Muni Income Fund (NAC), recommends Tim Melvin, editor of Underground Income.

When markets are extremely fearful, riskier funds will be heavily discounted, pay large distributions, and have activist shareholders. The odds will be in our favor.

Until that happens, our three selection criteria—an asset class ripe for mean reversion, heavy discounts to net asset value (NAV), and an activist presence—have steered us into the perfect asset allocation for 2023.

We are long on fixed-income, cash-producing energy infrastructure, and cash. We are at about 50% of the level I consider fully invested. Why?

We are going to have a recession later this year or next year. The data says it is almost inevitable. Inflation is not going away as quickly or easily as many so-called experts had hoped. And we are already seeing some dings of an economic slowdown—while employment has been resilient, it is cracking ever so slowly.

Dealing with a recession and uncertain markets is never fun, but we are well positioned for one. Meanwhile, let’s talk about NAC.

Tax-free bonds now have a taxable equivalent yield well above the long-term yield of Federal Government Bonds. While municipal bonds are not immune to fluctuations due to economic gyrations, they tend to be more muted.

Market conditions this summer are likely to be influenced by a very light new issue calendar.

We are closer to the end of the rate hike cycle than the beginning. Holding Munis through the impending recession should be a very profitable endeavor in terms of both cash flows and potential gains.

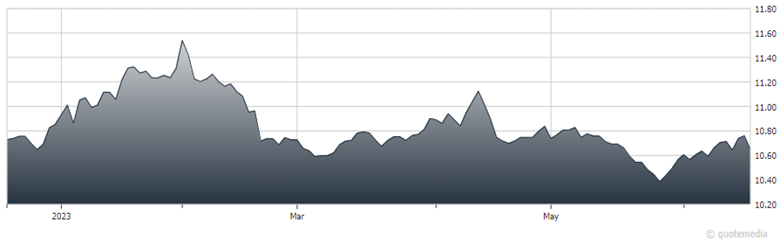

Nuveen California Quality Muni Income Fund (NAC)

A significant portion of the bonds held by the fund were issued when rates were lower and have declined in price. Add in the recent 15.67% discount on the net asset value at which the fund shares were trading, and we have our own version of a discount double play.

The recent yield was 4.08%, giving us a taxable equivalent yield of 7.4% for middle-bracket California buyers. A top-bracket buyer is closer to almost 8%.

An out-of-state buyer is still getting almost 6.8% TEY from state and local government bonds.

The portfolio is focused on high-quality bonds with little chance of default. The safety of municipal bonds is second only to US Treasuries.

Recommended Action: Buy NAC, but do not pay over $11.