We are raising our rating on Abercrombie & Fitch Co. (ANF), a global specialty retailer that operates Hollister and Abercrombie brand stores, to “Buy” from “Hold”. Our target price is $41, updates Kristina Ruggeri, analyst at Argus Research.

The company has been transitioning away from larger-format, tourist-dependent flagship locations to smaller stores that cater to local customers. It has also broadened its offering to include office and special occasion clothing, as well as active apparel.

In response to weaker sales to teenage consumers in 2022, it has also refocused the Abercrombie banner on adults ages 22 to 45. In addition, ANF is expanding margins, helped by lower freight costs, and lowering inventories as supply-chain disruptions ease. The company also continues to strengthen its digital capabilities.

Abercrombie & Fitch Co. (ANF)

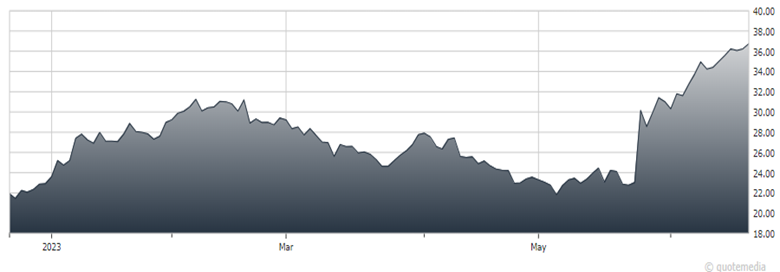

ANF shares have advanced 27% over the past quarter, compared to a flat performance for the S&P 600 and a gain of 10% for the industry. Over the past year, the shares have risen 77%, compared to a loss of 1% for the index and a 9% gain for the industry. Over the past five years, the shares have advanced 30%, compared to gains of 17% for the index and 39% for the industry.

ANF recently posted fiscal first-quarter results that exceeded consensus expectations. The company reported fiscal 1Q24 adjusted EPS of $0.39, up from a loss of $0.27 per share a year earlier and above the consensus loss estimate of $0.05 per share.

Net sales totaled $0.8 billion, up 3% from the prior year as reported and 4% in constant currency. Comp sales were also up 3%. The adjusted operating margin expanded by 530 basis points to 4.6%, helped by favorable comps.

In response to a sharp drop in demand from teenage consumers in 2022, the company repositioned its brands with help from an external ad agency. As a result, the Abercrombie banner now targets adults ages 22 to 45. It has also broadened its assortment by adding office and special occasion clothing, and active apparel.

These changes should expand the total addressable market for the banner and help to increase sales. The Hollister banner has also expanded its assortment and is now focusing solely on the teenage market.

Along with the fiscal 1Q results, management updated its guidance for FY24. It now looks for FY24 net sales growth of 2%-4% and an operating margin of 5%-6%, which assumes declines in both freight and raw material costs. It previously projected FY24 net sales growth of 1%-3%, with an operating margin of 4%-5%. It continues to project full-year capital spending of $160 million.

Recommended Action: Buy ANF.