The crisis in Russia is grabbing headlines. But don’t buy gold because of a geopolitical crisis in Russia or anywhere else. And don’t listen to anyone trying to sell you bullion based on this type of turmoil. Instead, accumulate gold because of something else entirely, advises Brien Lundin, editor of Gold Newsletter.

After Paul Volcker quelched the inflationary fires by raising rates to 20%, the Fed governors and chairmen were a bit more circumspect in their machinations. But they all had the same recipe for any hiccup in the economy: Easier money.

For almost three decades, this simply meant lowering the fed funds rate whenever a recession or slowdown came around. And then, once the economy got back on its feet, the Fed would begin to raise and “normalize” rates.

You know the rest: They were never able to raise interest rates to previous levels. In fact, they weren’t even able to raise them to the mid-point of the previous cycle before being forced to begin lowering them again to address another slowdown or crisis.

Eventually, they got to zero, and were forced to come up with new, desperate measures like quantitative easing to provide liquidity to the voracious markets, in addition to fiscal largesse from Congress.

Those initial programs developed after the Great Financial Crisis in 2008 were multiplied after the Covid pandemic hit. What took four to five years to accomplish post-2008 was done in four to five days.

And it was these monetary events — not geopolitical crises — that took gold to new record heights.

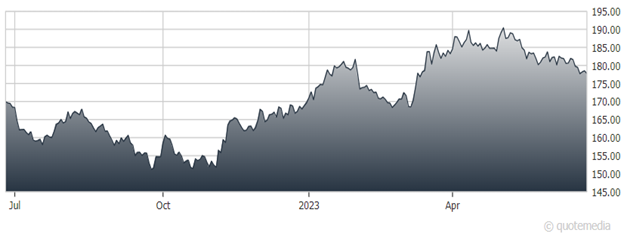

SPDR Gold Shares ETF (GLD)

Now if we zero in on the present, the near-revolution in Russia came and went before it had a chance to launch the gold price higher.

But if it had, the price would have quickly fallen to where it was before, and possibly lower, once the crisis had passed. The vast majority of investors would have been left holding the bag.

It’s important to understand this dynamic, because there will be more such events in the future. In fact, more remains to be written in this latest chapter in Russia’s violent history.

The lesson is this: There’s no actual rationale for the world buying gold in the teeth of such geopolitical uncertainty. Gold protects against the long-term depreciation of currencies, and these flash points come and go without having any lasting effects on these factors.

That said, there are valid monetary reasons to accumulate gold in the current environment. Consider that, while gold has lost over $100 over the past two months, it remains within about 6.5% of an all-time nominal record high.

In short, the gold price has actually done fairly well, and has remained at highly elevated levels for some reason.

What could that reason be?

Simply put, the gold market is recognizing that whether the Fed raises rates another once or twice, this rate-hike cycle is peaking. And the next move will be lower, either due to a recession or the next crisis spawned by the central bank’s latest policy overreaction.

With that next, inevitable event, gold will rise well past the old records to much higher levels. The timing remains in question, but it’s relatively soon.

My advice: Accumulate gold because of the relentless, multi-decade trend of currency devaluation that is now nearing its endgame.