I want to own stocks that generally yield 3.5% or more, grow their dividend by a meaningful amount every year, and generate plenty of cash flow to be able to afford and raise the dividend. I call this my 10-11-12 System of investing in Perpetual Dividend Raisers, and Ally Financial (ALLY) is a good stock to illustrate how it works, counsels Marc Lichtenfeld, chief income strategist at Wealthy Retirement.

Because I have a number of years until retirement, I reinvest the dividends, which compounds my wealth. For those of you who are unfamiliar with the concept, it goes like this: When a company pays dividends, you can collect the dividends in cash or automatically buy more shares of stock.

For example, ALLY pays a $0.30 per share quarterly dividend for a recent yield of 4.3%. If you bought 200 shares at the recent price of $27.77, this quarter, you’d get paid $60 in dividends ($0.30 dividend x 200 shares = $60).

If you reinvested the dividend, you’d automatically buy 2.16 more shares based on the same price ($60 dividends / $27.77 share price = 2.16). Of course, the price could be higher or lower. If it was lower, you’d buy more shares, which would generate more dividends.

The next quarter, if the dividend was the same, you’d get paid $60.64, which automatically would be used to buy more shares. That additional $0.64 seems like nothing, but if Ally raised the dividend at just half the pace it’s been raised at over the last seven years, your original $5,554 investment would nearly double to $10,102 in five years.

That’s if the stock simply kept pace with the historical average of the S&P 500. In other words, it wasn’t a world-beater. Just an average stock with a strong yield and terrific dividend growth.

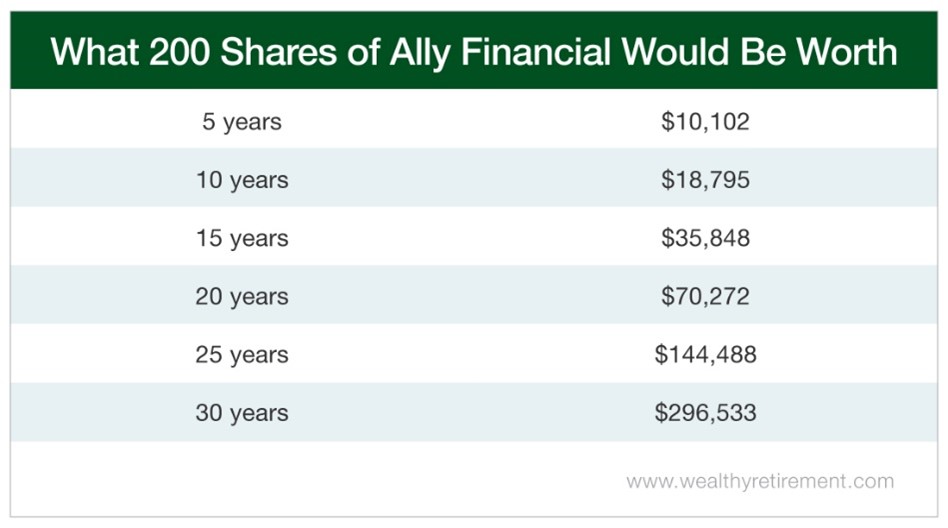

Here’s what that original investment would be worth over various periods of time.

You can see that after just 10 years, your investment would be up 3 1/2 times. It would double again in another five years to give you nearly seven times your original investment.

Each additional five years would nearly double the nest egg again. After 30 years, you would’ve made more than 53 times your money – not by chasing the next home run but instead by owning a “boring” dividend stock.

There is nothing boring about that!

Recommended Action: Buy ALLY