While much of our emphasis is on mid-cap and large-cap turnarounds, there are often attractive turnarounds in the small-cap segment of the market. Our feature recommendation this month, L.B. Foster (FSTR), is an attractive one, explains Bruce Kaser, chief analyst at Cabot Turnaround Letter.

Companies in the small-cap group, with market values generally below $1 billion, tend to be more different from their larger peers than commonly perceived yet also offer worthwhile investment opportunities.

Investors generally work into their positions with care and tend to use limit orders. However, greater risk can sometimes bring greater rewards. Small-cap turnaround stocks typically sell at discounted valuations. New leadership and the right conditions can propel them sharply upwards.

L.B. Foster is a small-cap manufacturing and distribution company with operations in the United States and Canada (combined 84% of sales), the United Kingdom (9%) and other countries. About 60% of its revenues are produced from railroad industry products ranging from rails to friction management to monitoring technologies.

L.B. Foster is a small-cap manufacturing and distribution company with operations in the United States and Canada (combined 84% of sales), the United Kingdom (9%) and other countries. About 60% of its revenues are produced from railroad industry products ranging from rails to friction management to monitoring technologies.

Foster is also a leading high-end supplier of precast concrete products (21% of sales), with the balance of its revenues produced from customized steel fabrication, coatings and measurement products and services.

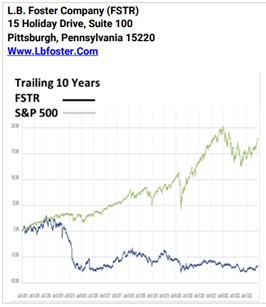

Following a surge through mid-2014, the company’s shares have struggled, falling 75% to a price unchanged since 2005. Frustration with its share price and weak operating performance, and pressure from activist investors including 22NW (12% stake) and Gabelli Asset Management (9%), led the company to undertake a strategic overhaul in 2021.

Foster has taken its turnaround seriously. Like nearly all turnarounds, replacing ineffective leadership is a key early step. The senior leadership team, including the CEO, CFO and key division heads, have been replaced.

Critically, the board has been refreshed and is now chaired by Raymond Betler, who previously led Wabtec Corp. (Westinghouse Air Brake) and brings deep leadership and rail industry experience.

Another valuable step for Foster was to end, at least temporarily, its otherwise steady stream of acquisitions and divestitures. These deals had led to unwieldy debt and overly complex operations.

Changes can take time to show up in financial results. Yet, Foster’s new approach appears to be working. Organic growth is improving, up 11.5% in the first quarter, with the gross margin improving to 20.2% from 16.6% a year ago. Adjusted EBITDA rose sharply, to $4.5 million, for a 3.9% margin compared to a 1.7% margin a year ago.

Like all turnarounds, Foster’s carries risks. But investor skepticism offers patient turnaround investors an opportunity to buy shares at a reasonable 7.7x estimated 2023 EBITDA, and at a highly discounted 4.6x EBITDA if it hits its 2025 targets.

Recommended Action: Buy FSTR.