Utilities are the original “bond proxies” of the stock world. Let’s not mince words — we’re interested in their dividends — but we’ll stay for price appreciation. It’s also an attractive quality during a manic market like this. Cohen & Steers Infrastructure Fund (UTF) is our “go to” utility play, advises Brett Owens, editor of Contrarian Income Report.

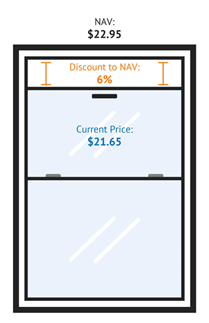

The fund recently yielded 8.8% and traded at a 6% discount to its NAV. This means we’re sneakily buying UTF’s holdings for 94 cents on the dollar.

UTF’s top holding is NextEra Energy (NEE), a well-run “growth utility” that I frequently praise at Contrarian Outlook. NEE yields a modest 2.5% and recently traded around $73.

Why not less than $69 per share for NEE, a 6% discount? This is the deal we’re getting when we buy UTF instead. Plus, the larger payout!

Wait. If NEE yields only 2.5%, why would we buy a fund that owns it? Because, as a CEF, UTF is allowed to use leverage to boost that paltry payout.

The catch today is that UTF’s cost of money, as with our bond funds, has increased with every Fed rate boost. But banks are failing, which means the Fed is just about finished hiking. Which means the bill for UTF’s 30% leverage won’t increase from here.

And remember, when we officially enter a recession, the Fed will cut rates. UTF’s cost of capital will decline, its price should rise, and vanilla investors will wish they loaded up on UTF right now.

Reaves Utility Income (UTG) is a good play here, too. UTG focuses more on “old school” utilities like Duke Energy (DUK) and Southern Co. (SO). These stocks tend to pay more than UTF’s infrastructure-focused plays, so UTG is able to use a bit less leverage (20% versus 30% for UTF) to deliver its elite 8.5% dividend.

UTG unfortunately does not trade at a discount, but this is nothing new. The fund frequently trades at premiums to its NAV. In recent years its premium has wandered as high as 13%!

Nope, we’re not interested in paying $1.13 for $1 in assets. But we’ll take the $1 for $1 UTF “fair trade” available recently. Especially at this near-term top in long rates, which should be a nice tailwind for the underlying holdings of UTG.

Really, lower rates are going to lift both UTF and UTG. These funds have minimal overlap in their holdings. It’s OK to buy both of these excellent 8%+ payers today.

Recommended Action: Buy UTF.