Here’s some great news as we head into the summer market doldrums: We've got a terrific setup to buy, with stocks rallying, economic data strong - and the S&P 500 (and many high-yielding closed end funds) still cheap. This is a great environment for equity CEFs like the Adams Diversified Equity Fund (ADX), explains Michael Foster, editor of CEF Insider.

These bargains exist because of the media’s constant bleating about a recession. But that, of course, has been completely wrong - and I expect it will continue to be.

Let’s talk about the economic data because it, of course, has a direct bearing on our summer buying opportunity. In May, durable goods orders rose 1.7% and new home sales soared 12.2%. Consumer confidence rose to 109.7 in June, the highest point in over a year. Those are just three data points Bloomberg pointed to in a recent article headlined: “Surprise, Doomsayers! You’re not in a Recession.” But they’re far from the best or most important facts.

GDP growth on a year-over-year basis accelerated last quarter. This is an important metric because we are comparing to 2022 and, for the first time, it’s clear that the brief weakening of growth in the middle of last year was the result of a COVID-19 hangover. The world was adjusting to a post-pandemic reality.

That brings us to a big question, though: Contrarian dividend investors that we are, should we hold off on purchases - or even pare back our holdings - as the recession narrative fades? The short answer is no. And again the data tells us why.

The S&P 500’s P/E ratio, at 22.2, is now back to where it was throughout the 2010s, (after the spike caused by the pandemic). That’s a sign that stocks aren’t in a bubble, and they have much more upside from here.

As for ADX, it sticks with tried-and-true names, including blue chips like Apple (AAPL), UnitedHealth Group (UNH), Visa (V) and JPMorgan Chase & Co. (JPM). That, along with the fund’s 6.5% trailing-12-month yield, are why we prefer it to index investing for blue-chip exposure.

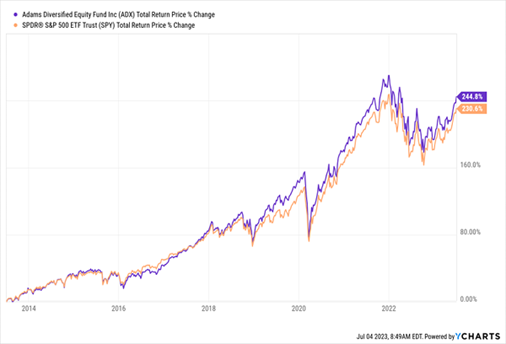

Plus, ADX has outrun the S&P 500 in the last decade:

Bear in mind that this chart shows total returns, including dividends. And we’ll happily take more of our gain in cash, as opposed to the “paper gains” index investors get, due to the S&P 500’s low 1.6% yield. Note also that ADX pays most of its dividend as a year-end special payout that fluctuates with net asset value (NAV), so it’s essentially converting paper gains to payouts for us.

The fund’s 15% discount to NAV is persistent, as investors don’t love ADX’s floating dividend, but that's fine by us. The performance is there, and we can look forward to more NAV - and by extension market-price - gains.

Recommended Action: Buy ADX.