The Dow Jones Utility Average finished 2022 more than 20 percentage points ahead of the S&P 500. So far this year, however, utilities are lagging by roughly the same amount. But the record is equally clear that so long as earnings and balance sheets stay solid, damage to stocks will be relatively mild and short-lived. Brookfield Renewable Partners (BEP) is my best fresh money buy for conservative investors here, notes Roger Conrad, editor of Conrad’s Utility Investor.

The S&P 500’s gains are thanks to the continuing surge in big technology stocks, which led by Apple (AAPL) at 7.673 percent are a record 37 percent of the benchmark index. Meanwhile, the DJUA at -4 percent year to date is tracking weakness in dividend paying stocks—as well as sectors considered “cyclical” and vulnerable to Federal Reserve rate increases and still-elevated recession risk.

What we haven’t seen is any real business weakness for utilities. In fact, aside from a handful of competition-hit telecoms, there’s little showing up anywhere among the 174 companies tracked in the Utility Report Card.

Starting later this month, calendar Q2 results and guidance updates will provide another opportunity to assess strength and weakness. But utilities’ flat borrowing costs versus January—combined with lower fuel costs and what’s been generally accommodative regulation—give every indication we’ll see a lot more good than bad, especially with portfolio stocks.

Starting later this month, calendar Q2 results and guidance updates will provide another opportunity to assess strength and weakness. But utilities’ flat borrowing costs versus January—combined with lower fuel costs and what’s been generally accommodative regulation—give every indication we’ll see a lot more good than bad, especially with portfolio stocks.

Historically, when the S&P 500 gets this top-heavy, it has eventually sold off hard. And if the economy slows enough, it’s reasonable to assume even relatively low-priced stocks of recession-resistant companies will take on water. But I don’t expect serious damage, which is why I like BEP.

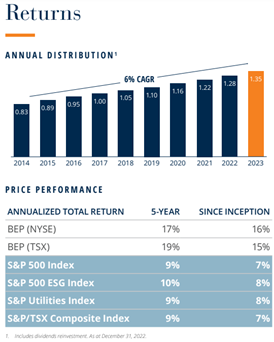

Not once since its November 1999 IPO has Brookfield Renewable Partners ever cut its dividend. Nor has the company missed an annual increase since 2009—when the rate was held flat following Canada’s death sentence for income trusts.

This spring, management raised by another 5.5 percent, in line with the CO2-free power producer’s annual target of 5 to 8 percent. Nonetheless, despite a solid gain this year, Brookfield sells under my Dream Buy price of 30 and 40 percent below the all-time high of early 2021.

Brookfield shares have taken a hit since the post-Biden election green energy bubble burst. But they’ve arguably also lagged since because of investor skepticism about the company’s aggressive acquisition policy. That includes ongoing purchases of the nuclear power services unit of Westinghouse, the energy retailing/generation business of Australia’s Origin Energy (OGFGY) and now 5.9 gigawatts of unregulated renewable energy capacity from Duke Energy (DUK), along with a 6.1 GW development pipeline.

I expect success for its deals and a resulting higher valuation for Brookfield in the next 12 months. All will boost needed scale and are at low enough prices to be immediately accretive to earnings.

Recommended Action: Buy BEP.