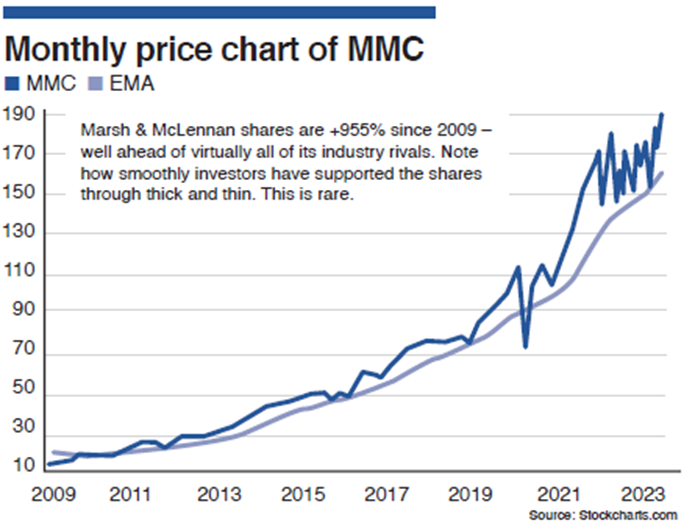

Financial stocks massively underperformed in the first half of this year. Nevertheless, my research suggests that financials’ turn may lie just beyond the corner, and that surge may very well be led by a set of dangerous, dominant, and disruptive companies in one of my favorite industries...insurance. Buy Marsh & McLennan (MMC), recommends Jon Markman, editor of Disruptors and Dominators.

MMC is a global professional services firm that operates in the insurance brokerage, risk management, and consulting industries. It was founded in 1871 in Chicago by Henry W. Marsh and Donald R. McLennan.

Initially, the company focused on providing insurance brokerage services to clients. Over the years, MMC expanded its services and acquired several other companies to diversify its offerings. Notable acquisitions include Mercer (a leading HR consulting firm) in 1959 and Oliver Wyman (a management consulting firm) in 2003.

Through these acquisitions and organic growth, MMC has become one of the largest insurance brokerage and consulting firms in the world. MMC’s prospects are promising due to the increasing complexity of risk management and growing demand for insurance and consulting services worldwide.

As risks in various sectors — such as cybersecurity, climate change and regulatory compliance — continue to evolve, businesses and individuals require specialized expertise to navigate these challenges. MMC is well positioned to capitalize on these trends, given its extensive global network, industry knowledge, and diverse range of services.

Why is it such a reliable earnings producer?

- Deep industry knowledge. This allows the company to provide tailored solutions and valuable insights to its clients, giving it a competitive advantage. MMC operates in over 130 countries, serving clients across various industries and sectors. Its global presence enables it to tap into diverse markets and benefit from a wide-ranging client base, which helps maintain a steady stream of revenue.

- Risk management & advisory services: As risks become more complex, businesses increasingly rely on MMC for risk assessment, mitigation strategies, and insurance placement. MMC’s risk management and advisory services provide value-added solutions, making it a trusted partner for clients seeking comprehensive risk management support.

- Strong relationships with insurance companies: MMC’s long-standing presence in the insurance industry has cultivated deep relationships with insurance carriers worldwide. These relationships enable MMC to negotiate favorable terms and competitive pricing on behalf of its clients, enhancing its value proposition.

Recommended Action: Buy MMC.