A leading Mortgage REIT (mREIT) in the multifamily and commercial lending space, Arbor Realty Trust (ABR), had a stellar first quarter. The company posted $110 million in revenues, up 30% YOY, notes Todd Shaver, editor of Bull Market Report.

ABR also reported a profit of $84 million, or $0.46 per share, against $64 million, or $0.40 per share a year ago. The beat on consensus estimates, along with other robust metrics, sent the stock on an extended rally.

This was an eventful quarter for the trust, with agency originations touching $1.1 billion, up 30% YoY, compared to $840 million a year ago. Its MSR stands at $29 billion, up 7% YoY, against $27 billion last year, followed by structured loan originations at $270 million, with this portfolio now nearing $14 billion. These figures are rather phenomenal, considering the tough macro environment in recent months.

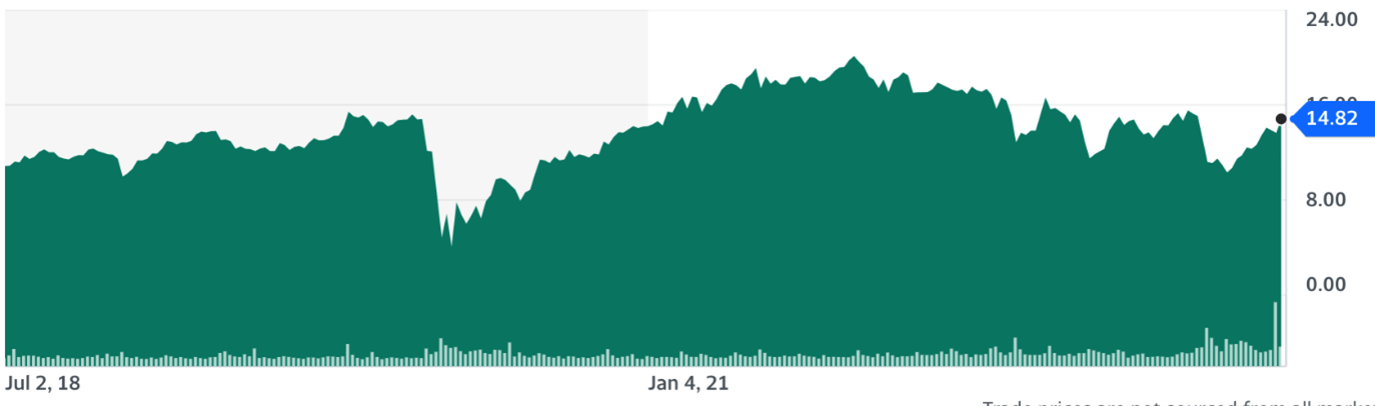

Arbor Realty (ABR)

Most mREITs have gone through a rough patch this year, but nothing compares to Arbor’s misfortune. Aside from the back-to-back rate hikes, the regional banking crisis, and recessionary fears, the stock was the target of an aggressive short report by Ningi Research.

It was a good thing we stuck to our guns, as the stock ultimately rallied from its multi-year lows, adding substantial value for investors in the process. The research report’s main accusation against the trust was its lack of substantial allowances, at just $40 million for a $13 billion multifamily loan portfolio.

However, it fails to consider that in the current environment, most multifamily borrowers are incentivized to convert their bridge loans into agency loans. They involve substantially lower risk and don’t require much in the way of allowances.

Following the rally in recent weeks, the trust remains better positioned than ever before, while offering well-covered dividend yield of 11.3%, all the while trading at a small markup to its book value. In anticipation of further uncertainties, the trust maintains a largely conservative balance sheet, with $1.5 billion in cash, cash equivalents, and restricted cash, $13 billion in debt, and $200 million cash flow.

Recommended Action: Buy ABR.