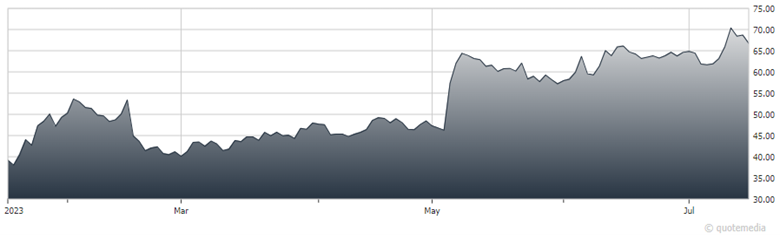

Editor’s Note: Todd Shaver, editor of The Bull Market Report, had the third best-performing recommendation from our annual “Top Picks 2023” Report through mid-year. The ecommerce company Shopify (SHOP) produced a total return of 73.7% during the tracked period. I reached out to him for updated commentary and guidance on his “Terrific Ten” stock, and this is what he provided...

Leading global ecommerce platform SHOP continues to release strong results. In the last full year, revenues came to $5.6 billion, up 22% from $4.6 billion a year prior. It was a rough year for profits, as they came in at $50 million, or $0.04 per share, down from $820 million, or $0.64.

But Shopify now owns a 10% market share in the US eCommerce market, with similar penetration across the globe. During the year, the platform catered to 560 million unique shoppers from all over the world, across its millions of merchants and their online storefronts.

Shopify (SHOP)

Why is the company so good? Because it allows a customer to create a website, set up credit card payments, and start selling their merchandise in hours. Yes, in hours. Shopify has made it a cinch to get started in business and hundreds of thousands have followed the company to creating wealth for themselves and their families.

Following a previous, painful 70% pullback in the stock, the company committed to cost optimization and refocusing on core growth vectors since the third quarter of 2022. The company has achieved a number of its goals in this regard.

As an extension of the same plan, the company has raised prices across all of its subscription services, from anywhere between 12% to 33%. This marks the first such change in its pricing structure in over 12 years.

This comes alongside a slew of other services and solutions that the company has unveiled in recent years. That includes Commerce Components by Shopify, introduced during the fourth quarter, which helps large merchants ramp up the Shopify platform quickly. Along with this is the integration of its recent $2 billion acquisition of fulfillment platform Deliverr, as part of its ‘Port To Porch’ initiative, aimed at allowing smaller retailers scale their operations across the world, while minimizing the various logistics and supply chain hurdles.

Shopify has consistently outperformed and outwitted competitors with its ceaseless innovations such as Shop Pay, Shopify Capital, Shopify Audiences, Shopify Markets, POS Go, and plenty more, creating insurmountable competitive fortresses for the company. The way things stand, its only major competitors are Google Shopping and Amazon, with its ‘Buy With Prime’ being the only credible threat.

Shopify’s acquisition of Deliverr, and the resulting stock-based compensation, along with rising operating expenses, have weighed on the company’s profitability. This, however, is hardly of any concern, especially given the extensive measures it has since taken to boost profits, and its robust liquidity profile, consisting of nearly $5 billion in cash, just over $1.3 billion in debt, and a cash burn during the year of $130 million. We would not sell Shopify.

Recommended Action: Buy SHOP.