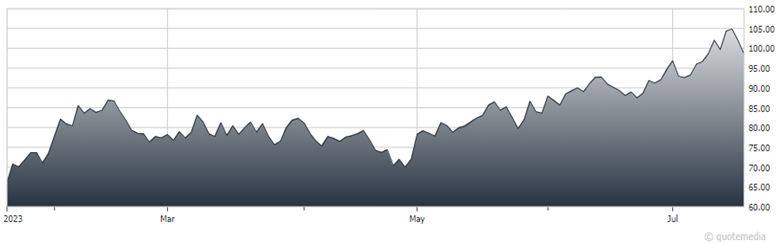

Editor’s Note: Richard Moroney, editor of Dow Theory Forecasts, had the ninth best-performing recommendation from our annual “Top Picks 2023” Report through mid-year. The chip sector standout ON Semiconductor (ON) produced a total return of 46.3% during the tracked period. I reached out to him recently for updated commentary and guidance on his “Terrific Ten” stock, and this is what he provided...

We still have ON Semiconductor on our Focus List, and have since November 2021. It has rallied 46% during its tenure on that list, while the S&P 1500 Index has retreated 7%.

Market-share gains in the automotive and industrial end markets have driven ON’s recent operating momentum. In late May, ON said it remained cautiously optimistic that its results for the second half of 2023 would be stronger than the first half. The consensus calls for per-share profits to slump 9% this year and rise 12% in 2024.

ON Semiconductor (ON)

The stock climbed 9% in a one-month period recently, contributing to a sub-par Quadrix Value score of 40. But, contrary to many stocks, ON has tended to perform best when it’s not excessively cheap.

When its trailing P/E ratio has fallen below 17 since 2000, the stock has proceeded to average a 12-month total loss of 2%, rising in just 29% of periods. When its P/E ratio has exceeded 17, as it currently does, the stock has averaged a 12-month total return of 26%, posting gains 72% of the time. ON is a Focus List Buy.

Recommended Action: Buy ON.