Earnings season is underway, and so far, corporate outlooks remain relatively upbeat, suggesting the economic cycle might improve. While it is too early to tell for sure, some evidence may support that view and the potential for the market to eclipse all-time highs by next year, writes Lance Roberts, editor of Bull Bear Report.

We recently wrote:

“New all-time highs are coming. Given the fundamental and economic backdrop, I know that seems hardly logical, but that is what the technicals now suggest. The market has decisively cleared its 78.6% retracement of last year’s decline. Historically, when that occurs, new highs are a likely outcome. The combined momentum of the market, rising bullish sentiment, and the need to chase performance by managers are contributing to the seemingly unstoppable rally from the October lows.”

However, we must remember that market advances can only go so far before an eventual correction occurs. My best guess is that if the markets are to reach all-time highs this year, we will likely have a correction to reset some of the more extreme overbought conditions.

Furthermore, the sentiment of both retail and professional investors is getting rather extreme, along with the recent drop in volatility, which also suggests a correction is likely.

We continue to suggest remaining patient and opportunistically increasing equity exposure as needed. While it may “feel” like you are missing the boat currently, the market will always give you another opportunity to get on board.

As with market cycles, the economy cycles as well. There is little argument the current economic data is fragile whether you look at the Leading Economic Index (LEI) or the Institute of Supply Management (ISM) measures.

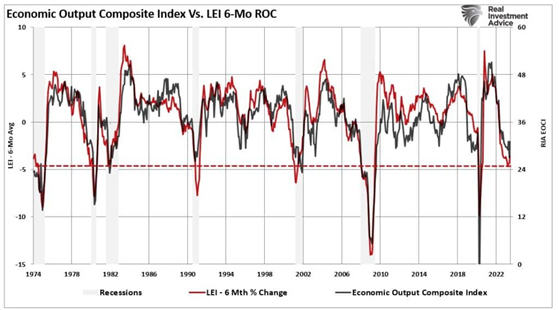

But long periods of slowing economic activity will eventually bottom and turn higher. The Economic Composite Index, comprised of 100 hard and soft economic data points, clearly shows the economic cycles. I have overlaid the composite index with the 6-month rate of change of the LEI index, which has a very high correlation to economic expansions and contractions.

These economic measures are at levels that have marked the bottoms of economic contractions outside financial crises or economic shutdown events. Such suggests that we may see some improvement in economic activity in the coming months. If that is the case, we should also expect the earnings cycle to improve.

With both technical and sentiment readings suggesting the short-term market risks are elevated, it is likely wise that investors use the current speculative frenzy to rebalance portfolio risks accordingly. Here is what I recommend:

- Tighten up stop-loss levels to current support levels for each position.

- Hedge portfolios against major market declines.

- Take profits in positions that have been big winners.

- Sell laggards and losers.

- Raise cash and rebalance portfolios to target weightings.