The good times are here again. The S&P 500 is up over 19% YTD and is now within just 4% of its all-time high. Stocks are in a strong uptrend that began in early May and appear likely to move still higher. AbbVie (ABBV) is one of my favorites, shares Tom Hutchinson, editor of Cabot Income Advisor.

Inflation is crashing. The Fed is about out of bullets. And there is no recession in sight. Things could always discombobulate down the road. But there doesn’t appear at this point to be anything ahead in the next month or so that will change the current positive narrative.

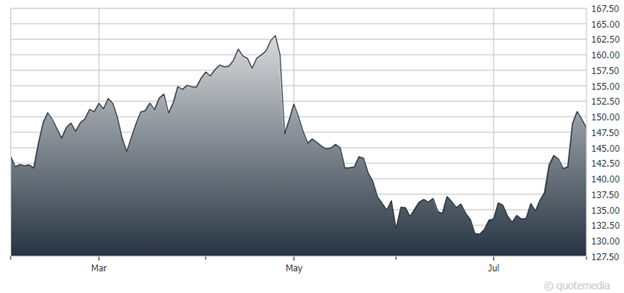

As for ABBV, this position was recently added. AbbVie reported results that beat on both earnings and revenue and the company also raised earnings guidance for the year. The stock has spiked more than 6% since the report.

AbbVie (ABBV)

Humira sales were down less than expected and AbbVie’s replacement immunology drugs did better than expected. The report underscores the notion that the revenue drop from the Humira patent expiration will be very temporary and AbbVie will turn the corner sooner than expected en route to a promising future.

Meanwhile, several stocks have moved into the range where there are opportunities to sell attractive calls against our positions. Ongoing narratives tend to be less fickle in the late summer as many investors tune out and go on vacation. But things can also change, and sometimes quickly. So, keep an eye out for alerts.

Recommended Action: Buy ABBV