It’s been a pretty good summer for investors so far. A preponderance of good economic reports – coupled with less aggressive monetary policy – has created favorable conditions for stocks, writes Brian Kelly, editor of Money Letter.

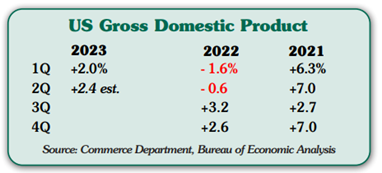

More specifically, we’ve seen consistently declining inflation rates and stronger-than-expected economic output (as measured by Gross Domestic Product, GDP). This has allowed the Federal Reserve to signal we’re at -- or near -- the end of their interest rate hiking cycle.

The S&P 500 was up another 3% in July after an outstanding month of June. The Dow Industrials just came off a 13-session winning streak. The Euro STOXX 50 Index and the Shanghai Composite were up in July as well.

In other words, we’re in a bit of a “sweet spot” as the calendar turns to August. The broad economy continues to be resilient, despite 11 interest rate hikes by the Fed since March 2022. Low unemployment and plentiful job opportunities have been key drivers.

Keep in mind the consumer accounts for about 70% of economic activity. With unemployment near historically low levels, it is not a surprise that consumer spending remains firm. We see this very clearly in the services sector where a ramp-up in spending continues.

Other measures support our argument. Durable goods orders, which are seen as a bellwether for business growth, surged in June. Even stripping out a spike in transportation equipment, orders for long-lasting goods rose by 0.6% in June after climbing 0.7% in May.

Other measures support our argument. Durable goods orders, which are seen as a bellwether for business growth, surged in June. Even stripping out a spike in transportation equipment, orders for long-lasting goods rose by 0.6% in June after climbing 0.7% in May.

All of this adds up to a surprise reading in 2nd Quarter GDP. Only 30 days ago, the Atlanta Fed forecast was for a reading of +1.9%. The official BEA first estimate on July 27 came in at 2.4%. Looking ahead, although it is very early days, the Atlanta Fed is estimating the 3rd Quarter reading to be +3.5%. No negative growth quarters here.

Although the economy is quite steady, there are some headwinds that could lead to future slowing. We will continue to monitor:

• Pressure on real wages.

• The resumption of student loan payments.

• The exhaustion of pandemic savings.

• Much higher credit card interest rates.

There is still a lot of talk of recession in the mainstream financial press. We don’t completely discount the possibility. But we don’t see a recession in 2023, and if there is one at some point in 2024 it will be mild in our view.