Leading US midstream company Kinder Morgan (KMI) recently reported quarterly results. As an early reporter and dominant player in its sector, its results are also a useful bellwether for what we’ll see at other companies in the next couple weeks, explains Elliott Gue, editor of Energy and Income Advisor.

Kinder’s Q2 results meaningfully beat the budget management had previously presented to investors. The main driver was taking advantage of commodity price volatility. But the company also successfully brought $450 million of new projects into service, while adding $500 million to what’s now backlog of $3.75 billion.

Now operating assets include renewable natural gas projects at its Kinetrex unit, which were slightly delayed in opening due to supply chain concerns but will nonetheless meet Kinder’s return benchmark. The Natural Gas Pipeline business (62.5 percent EBDA) enjoyed increases of 5 and 19 percent in transport and gathering volumes, respectively, for a 6 percent EBDA lift from a year ago.

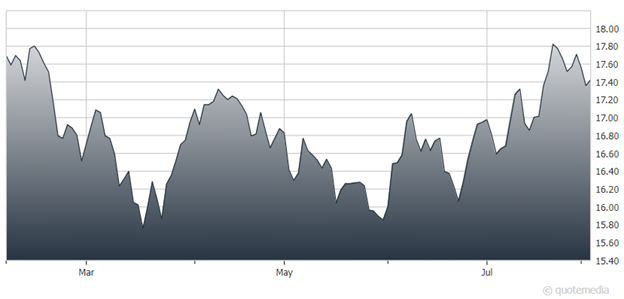

Kinder Morgan (KMI)

Products Pipelines (14.9 percent EBDA) saw a slight decline in EBDA. A 9 percent boost in jet fuel and 4 percent improvement in crude/condensate volumes were more than offset by -1 percent and -4 percent declines in gasoline and diesel volumes, respectively.

Terminals earnings (13.6 percent EBDA) were up 3.2 percent, keyed by increased charter rates on Jones Act tankers and improved utilization at refined product hubs in New York Harbor and the Houston Ship Channel.

Lower realized selling prices of natural gas liquids and CO2 prices drove down results at the CO2 unit (9 percent EBDA). And though volumes were generally in line with expectations, the unit is expected to remain a drag on results in the second half of the year. That’s the primary reason for management’s tepid guidance in second half of 2023.

But the big picture for Kinder is the same as it’s been for several years. That’s a dominant midstream company keeping a lid on expenses (Q2 operations and maintenance expense up just 3.3 percent), maintaining steady margins thanks to operational and asset diversification, and executing on its long-term strategy of expanding share in natural gas transportation.

Higher interest expense from eliminating exposure to floating rate debt resulted in Q2 distributable cash flow per share -8 percent below year ago totals. But DCF still covered the dividend by a healthy 1.7 times. And the company generated $378 million in Q2 free cash flow after dividends paid, which it used to reduce debt, buy back stock and stockpile for future acquisitions.

Recommended Action: Buy KMI.