Electric vehicle sales are booming. And thanks to the recent market pullback, you’ve got an opportunity to climb aboard before things shift into higher gear. One of my favorite plays is the Global X Autonomous & Electric Vehicles ETF (DRIV), writes Sean Brodrick, editor at Weiss Ratings Daily.

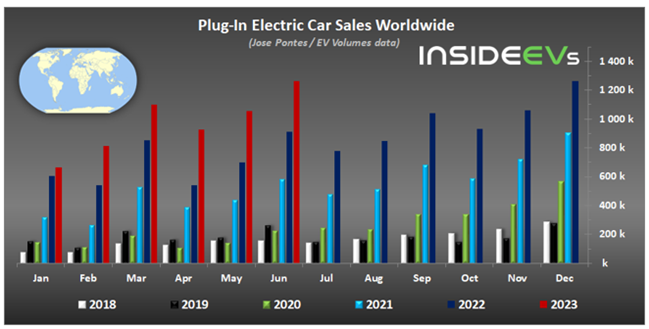

Not that sales aren’t zooming along already. According to the latest data from InsideEVs.com, 1,260,470 new passenger plug-in EVs were registered globally in June.

That’s an increase of 38% year over year. Putting it another way, 19% of the total global car market — nearly 1 in 5 new cars — is now an EV.

The red bars on this chart show 2023 EV sales. You can see they tower over sales in previous years.

Now, detractors will point out that one-fifth of auto sales is still small. And they’re right. But the way sales are accelerating should grab some eyeballs. Not only in the US, but all around the world.

From 2020 to 2028, EV market share rallied from 2% to 7% — more than a triple. In the European Union, market share for EVs jumped from 10% to 21%. In China, which has more than half of all EVs on the road, the market share soared from 5% in 2020 to 28% in 2022.

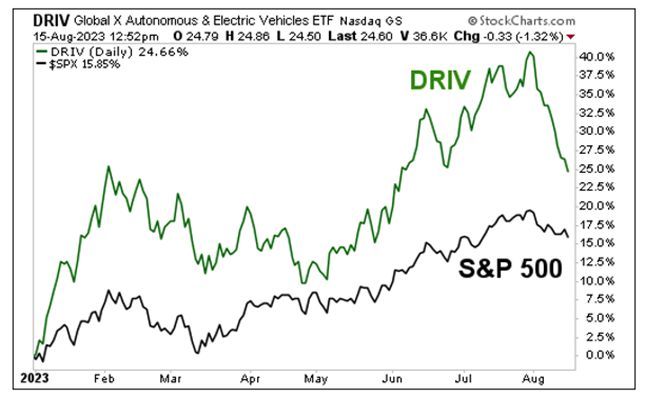

An easy way to ride this trend is to buy one of the popular EV exchange-traded funds. There are a bunch of them, and they have been on a wild ride this year, with a steep pullback in August as the broad market sells off.

Of these, the one with the most volume is DRIV. It also has the best performance for the year, even after the big pullback (so far) in August …

You can see that DRIV was recently up 23.6% so far this year, much better than the 15.8% gain in the S&P 500. Corrections end eventually, and when this one does, I expect DRIV to vroom vroom again. DRIV has an expense ratio of 0.68%, and big names like Nvidia (NVDA) and Tesla (TSLA) are among its top holdings.

Recommended Action: Buy DRIV.