Leading biotechnology company and mRNA pioneer, Moderna (MRNA), recently released its second-quarter results. While they showed deterioration due to the seasonal nature of its COVID-19 vaccine sales, the future looks bright for Moderna, argues Todd Shaver, editor of Bull Market Report.

The company posted $340 million in revenues, down by a colossal 94% YoY, compared to $4.7 billion a year ago. It further posted a loss of $1.4 billion, or $3.62 per share, against a profit of $2.2 billion, or $5.24.

While this was expected as the world moves on from the pandemic, the company expects $6 to $8 billion in revenues from its COVID shot this year, with the US alone expected to buy anywhere between 50 to 100 million doses for the fall. Its updated COVID vaccine, targeting the omicron subvariant XBB.1.5., is still awaiting FDA approval. But it will be ready for a rollout over the coming months.

The company is confident of seeing robust demand for the shot, not just in the US, but also in Europe, Japan, and other leading markets. With COVID-19 becoming ubiquitous, Moderna expects this great business to continue.

Far from resting on its laurels, however, it has gone all out to ensure its pandemic windfall is used towards developing more sustainable products. This includes a robust pipeline of vaccines targeting cancer, heart disease, and a slew of other conditions, and are all set to hit the market by 2030.

This pipeline includes its experimental vaccine for respiratory syncytial virus, aimed at adults aged 60 and above, followed by its personalized cancer vaccine in partnership with Merck & Co. (MRK). It passed its first major clinical trial early last month with flying colors.

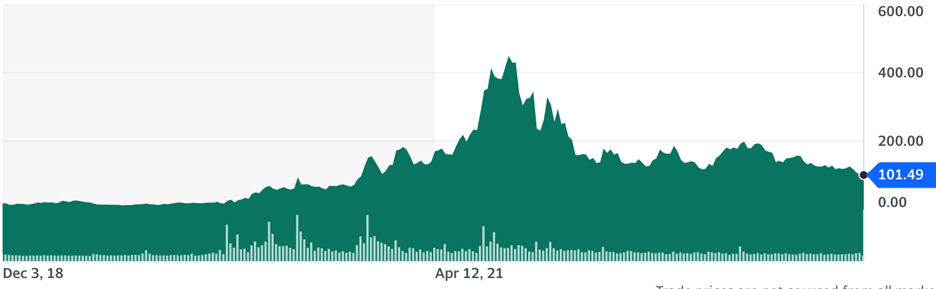

MRNA is down by 44% YTD and over 78% from its all-time high in 2021, and as such, is quite de-risked. It currently trades under four times sales and 35 times earnings, which might seem rich, but is perfectly justified for a growth stock such as this.

It has since repurchased stock worth $1.5 billion and ended the quarter with $8.5 billion in cash, $1.2 billion in debt, and negative $230 million in cash flow.

The company is worth $39 billion now. At its peak, it was worth $189 billion. Can it go there again in the future? We believe so.

Recommended Action: Buy MRNA