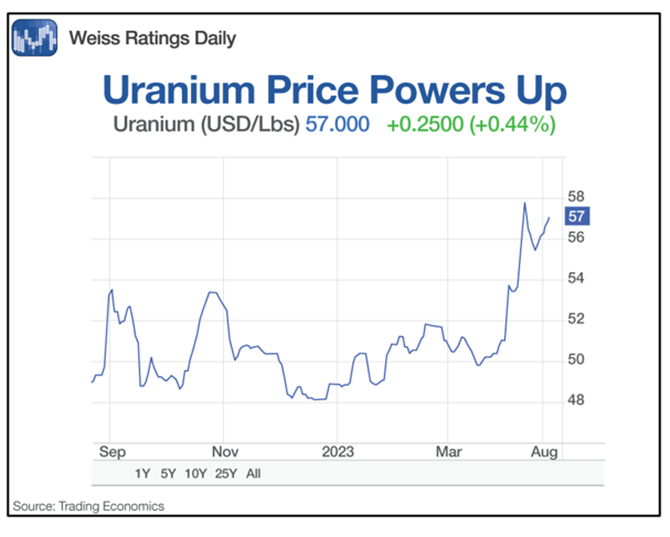

Uranium miner Cameco (CCJ) is poised to make a radioactive mountain of money. The good news on uranium comes in the form of one very telling chart, which you’ll find below, writes Sean Brodrick, editor of Resource Trader.

Take a look:

This one-year chart shows uranium hit a 14-month high in June, pulled back a bit, and now is going up to test that overhead resistance. That looks bullish to me.

The fundamentals behind the move are easy. On the demand side, we see growing global demand, as nuclear power becomes the obvious backup choice for “green” energy like solar and wind. On the supply side, the squeeze is on. A coup in Niger threatens supply coming from the world’s seventh largest uranium producer. Niger’s neighbors don’t like the coup and may take military action.

At the same time, the US and the European Union are both working on laws to cut or halt imports of Russian uranium and uranium enrichment services. Then there’s the fact that the price of uranium was so cheap for so long, there was little incentive to build new mines.

That brings us to Cameco. The company is the biggest uranium miner in the Western world. Most of its operations are in Canada’s Athabasca Basin, though it also does in-situ recovery in the US and Kazakhstan.

The company recently issued earnings results that many on Wall Street found disappointing. Quarterly revenue, which came in at $482 million, was down 14% relative to the same period last year.

But hidden in that dark cloud was a silver lining: Cameco raised its consolidated revenue outlook for 2023. Cameco also expects to sell higher volumes of uranium this year.

The company’s long-term commitments require an average annual delivery of 28 million pounds of uranium over the next five years. Compare that to the 26 million pounds reported at the end of March.

Most of those are fixed-price contracts. That means those contracts won’t benefit from rising uranium prices. However, Cameco is also signing more market-priced contracts. Those contracts may have a floor and a ceiling in them, but they also offer exposure to rising uranium prices.

What’s more, Cameco expects to deliver between 31 million and 33 million pounds of uranium this year, a boost from previous expectations of 29 to 31 million. Nice!

No wonder Cameco’s earnings are forecast to increase 148% this year after rising 227% last year. And next year, earnings are projected to rise ANOTHER 111%.

The company is also stuffed with cash — $1.85 billion worth. And it has a small dividend yield, but that yield is projected to rise 5.27% per year for the next three years.

Recommended Action: Buy CCJ