High-yield, high-quality bank stocks were recently as cheap as they were during the last three major bear markets – or sometimes, even cheaper. While our financial stocks have staged an impressive rally since then, we are not done yet. Banks have merely gone from ridiculously undervalued to the point of gross stupidity to merely deeply undervalued. I like Sandy Springs Bancorp (SASR), highlights Tim Melvin, editor of The 20% Letter.

When we look at the broader market for community bank stocks using the 145 stocks in the First Trust NASDAQ ABA Community Bank Index Fund (QABA), the average stock is still trading at just ten times earnings and 1.1 times book value. The index yield is 3.65%.

Our portfolio of banks — excluding PacWest (PACW), which I consider to be a special situation due to the impending merger — currently trades at an average P/E of just 8.8, with a price-to-book value of 0.89. The average dividend yield is 5.1%. The stocks still on the “buy” list have an average yield of 5.5%, with a P/E of 8 and a price to book of just 0.76%.

One market concern: Lending standards. We recently saw the results of the Federal Reserve’s quarterly Senior Loan Officer Opinion Survey, which interviews bankers about their willingness to make loans, and it was not good news. I will spare you a long-winded explanation. The reports found that bankers are not willing to make loans right now.

Mark Twain once said, “A banker is a fellow who lends you his umbrella when the sun is shining but wants it back the minute it begins to rain.” And it is raining. Lightly for now, but those who read more than the headlines can see that dark clouds are piling up at the far edge of the horizon. Yet if we look back over the last few months, we have seen bank stock prices already adjust to reflect that.

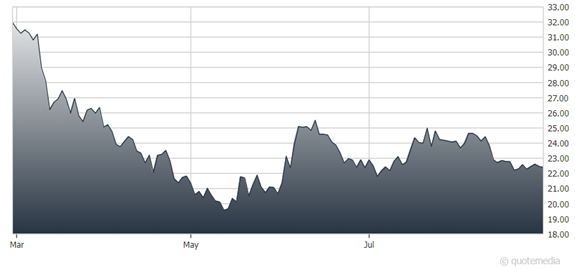

Sandy Springs Bancorp (SASR)

As for SASR, it’s based in a Washington, DC, suburb and has branches in my old stomping grounds of Anne Arundel County, Maryland, where Annapolis is located. I have met some of the board members over the years.

Sandy Spring is a business-focused bank with fantastic credit quality in the loan portfolio and a strong balance sheet. The bank was recently trading at just seven times earnings and 71% of book value. The yield was 5.5% at the current price.

Recommended Action: Buy SASR