With money market funds and CDs paying 5 percent plus, many investors are asking how dividend stocks can compete on yield. The far more relevant question: How they stack up on total return over a meaningful period of time. And on this score, cash alternatives don’t come close to matching up. I like Essential Utilities (WTRG) here, writes Roger Conrad, editor of Conrad’s Utility Investor.

Not since 1999 have essential services sectors lagged market averages by this great a margin. Year to date, the Dow Jones Utility Average has dropped by nearly 10 percent. The S&P 500, in contrast, is ahead by 16 percent. And despite losing some momentum recently, the Nasdaq 100 is up better than 40 percent.

This investing environment has plenty in common with that of a quarter century ago. Then as now, the Federal Reserve was pushing up interest rates to roll back the immense monetary stimulus it had used to quell a financial crisis.

Investors chased momentum and largely ignored valuation. Dividends were decidedly out of favor. And media buzz was all about transforming technologies, much as artificial intelligence dominates today’s headlines.

The aftermath of 1999 was the Great Tech Wreck. In 2000, the Nasdaq 100 crashed -36.8 percent while the DJUA surged more than 50 percent. And while market history never exactly repeats, the further momentum runs in one direction, the more dramatic the eventual reversal.

It is vitally important, however, that utility stocks we own stay strong as businesses. That’s how they’ll avoid unrecoverable losses in the current environment and make the most of a future rally.

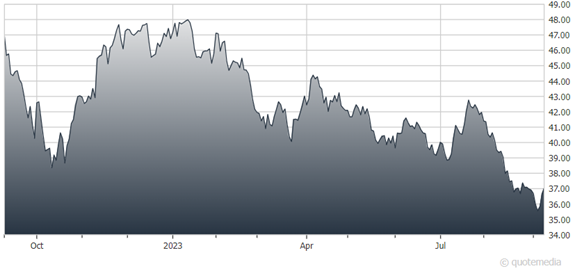

Essential Utilities (WTRG)

This month’s top pick for the conservative is WTRG. Adding water and wastewater customers by acquiring cash-poor systems on the cheap, then upgrading systems under reliable rate plans: That’s been the formula for the company’s reliable 7 to 10 percent annual earnings and dividend growth since the early 1990s, when it was known as Philadelphia Suburban.

With ownership of America’s water utilities still widely dispersed, there’s no shortage of potential takeover targets. And by steadily gaining scale year-in, year-out, Essential is better positioned than ever to do deals, closing seven this year to add 11,000 new customers and four deals pending to add 208,000 more.

Management guidance is for 6 to 7 percent annual growth in its regulated water rate base through 2025, fueled by a combination of system spending and 2 to 3 percent customer growth based on conservative assumptions for acquisitions. The company also owns a well-run Pennsylvania natural gas utility on track for 8 to 10 percent annual rate base growth, solely on regulator-approved plans to boost resiliency.

Recommended Action: Buy WTRG.