UnitedHealth Group Inc. (UNH) is a Dow Jones component that is America’s largest insurer and one of the world’s largest private health insurers. It’s a goliath with $348 billion in annual revenues that serves 149 million members in all 50 states and 33 countries. That’s a lot of monthly insurance premiums, writes Tom Hutchinson, editor of Cabot Dividend Investor.

The company operates in two primary groups, UnitedHealthcare and its Optum franchises. UnitedHealthcare provides health insurance and benefits to a wide range including large national employers, public sector employers, mid-sized employers, and small businesses and individuals. It also provides health insurance for Medicare and supplements as well as employers globally.

The Optum franchise provides direct healthcare, technology services, and prescription drug solutions. The direct healthcare includes an alliance with 70,000 physicians in local medical groups as well as ambulatory care systems and other chronic treatments. The technology provides data and analytics to manage complex administrative and regulatory issues with hospitals and physicians. It also provides a full spectrum of pharmacy care services.

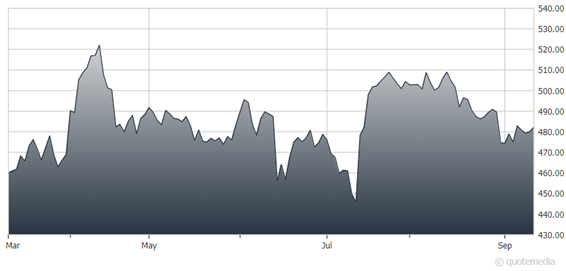

UnitedHealth Group (UNH)

The group supplies services for just about every facet of the healthcare process and the full-scale operation provides a powerful alignment of incentives that helps clients control costs better than competitors, which is a massive issue in the industry.

It’s also a huge company and operation. Scale is hugely important in this industry. It enables UnitedHealth to keep costs down by virtue of volume, to have cash for acquisitions, and to wield significant power to adjust rates as prices increase. That’s a huge benefit during inflation.

Although UNH is large in scale, the stock has managed to blow away the returns of the overall market, with more than twice the return over the past three- and five-year periods, and quadruple the return over the last 10 years. UNH has also done this with considerably less volatility than the market, with a beta of just 0.67.

Sure, UnitedHealth has the huge tailwind of the aging population, but so do many other stocks in the healthcare sector. I chose UNH because it has also been a consistently strong performer. It has significantly outdone its peers as well as most large healthcare stocks of any stripe.

Recommended Action: Buy UNH.