The stock market has been volatile. It’s been moving up or down primarily in reaction to interest rates and the economy. But the technicals remain bullish, and that’s why we still recommend the S&P 500 ETF Trust (SPY), write Mary Anne and Pamela Aden, editors of The Aden Forecast.

Sure, the market could have some setbacks along the way and maybe even some surprises, but so far, so good. And until this changes, we continue to advise keeping your stocks and holding on for further upside action.

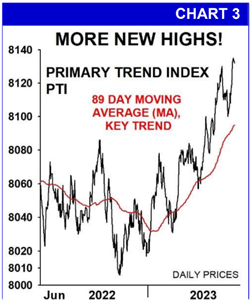

The shining star this month has been the late, great Richard Russell’s famous Primary Trend Index (PTI). This indicator was put together by Richard many years ago, using several indicators he felt were key in identifying the primary trend of the stock market. This composite is the PTI and we follow it closely, updating it every day on our website.

The shining star this month has been the late, great Richard Russell’s famous Primary Trend Index (PTI). This indicator was put together by Richard many years ago, using several indicators he felt were key in identifying the primary trend of the stock market. This composite is the PTI and we follow it closely, updating it every day on our website.

Currently, the PTI has been hitting new record highs. This is very bullish action and it doesn’t happen often. But when it does, it’s a strong sign that the stock market’s primary trend is clear and stocks are headed higher.

So why have stocks been falling the last few weeks? One reason of course is higher interest rates. These tend to put downward pressure on stocks and any signs they’re going to rise further makes the stock market nervous.

But it looks like interest rates are near a top. And if they are, that’ll be good for stocks, especially once they start to come down perhaps later this year or in early 2024.

Higher interest rates also make the economy more vulnerable and signs of weakness make the market

jittery. The Leading Economic Index, for instance, has now declined for 16 consecutive months. This is the longest down streak since 2007-08 and we all know what happened after that.

Consumer confidence has also declined and so did industrial production. Many have been expecting a recession for quite some time, but it hasn’t happened yet. In fact, now the Fed says there won’t be a recession, but at this point anything is possible. Yes, we could have a soft landing but maybe not.

Regardless, our leading indicators are still telling us that this decline is a normal downward correction following the steep stock market rise of the past few months. In other words, this is not the beginning of a bear market decline.

Recommended Action: Buy SPY.