We are generally not the biggest fans of private equity. Our biggest concern is that, while earlier private equity and venture capital funds were remarkably successful in identifying and capturing highly profitable investments, more recent vintages have mostly produced large profits for the fund managers. Meanwhile, take a look at a tech-sector value play: Cisco Systems (CSCO), writes Bruce Kaser, editor of Cabot Value Investor.

News that many Johnny-Come-Lately funds will actually lose significant money on the Instacart (CART) IPO highlights this problem. High-quality and early movers will likely post enormous profits. Similarly, decades ago, pioneering private equity funds were rare, so they had an open field of very attractive targets.

Today, there are so many of these funds that most of the best targets have been privatized already. As Warren Buffett once said, “What the wise do in the beginning, fools do in the end.”

Another problem is their claim to lower asset volatility relative to public markets. This may sound like a valuable trait, but it is an illusion. As private equity funds value their assets only once a quarter, they are by definition lower volatility than public equities which have daily marks.

The term “volatility laundering” humorously (or not) was coined to highlight this bug. Similarly, private equity funds get to value their investments at whatever price they want. Sometimes, these values can merely loosely reflect public market valuations. Often, the valuations reflect aspirations rather than reality.

Any public equity investor that reported aspirational prices rather than market prices would be fired by their clients and likely referred to the SEC. Public equity investors may be getting the short end of the stick by missing out on some early-stage wonders. But value investors can pick up worthwhile bargains as growth investors focus on the remaining public unicorns.

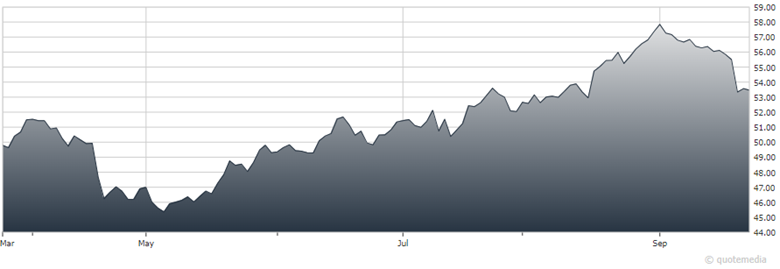

Cisco is a prime example. The company is facing revenue pressure as customers migrate to the cloud and thus need less of Cisco’s equipment and one-stop-shop services. But Cisco’s prospects are starting to improve under a relatively new CEO, who is shifting Cisco toward a software and subscription model and is rolling out new products, helped by its strong reputation and entrenched position within its customers’ infrastructure.

The company is highly profitable, generates vast cash flow (which it returns to shareholders through dividends and buybacks), and has a very strong balance sheet. I believe the shares have 17% upside to our 66 price target.

Based on fiscal 2024 estimates, the valuation is attractive at 10.1x EV/EBITDA and 13.3x earnings per share. Note that estimates have been adjusted forward with the completion of Cisco’s July 2023 fiscal year.

Recommended Action: Buy CSCO