New Pacific Metals (NEWP) announced its inaugural compliant resource estimate on Carangas in Bolivia. The silver-gold polymetallic deposit is impressive, containing an indicated 559.8Moz AgEq, made up of 205.3 million ounces of silver, 1,588.2 thousand ounces of gold, 1,444.9 million pounds of lead, 2,653.7 Mlbs of zinc, and 112.6 Mlbs of copper, notes Peter Krauth, editor of Silver Stock Investor.

In addition, their inferred resource is 109.8 Mozs AgEq, consisting of 47.7 Mozs of silver, 217.7 Kozs of gold, 297.9 Mlbs of lead, 533.7 Mlbs of zinc, and 16.8 Mlbs of copper. This puts Carangas into the category of globally significant silver-gold polymetallic discoveries, with recoveries estimated at 90% Ag, 98% Au, 83% Pb, 58% Zn and Cut-off grade of 40 g/t AgEq.

My rough calculations put the silver content at just below 40%, which is okay. In addition, since mineralization starts at surface, we could well see this become an open pit with about a 1.8:1 strip ratio, which is quite good.

The conceptual pit would have a diameter of about 1.4km and reach a depth of about 600m. And below this conceptual pit, there is gold-rich material that’s similar in size and grade to the Lower Gold Zone, which might be mineable through underground methods. What’s more, the gold mineralization is open to the north and northeast at depth. So, this resource has room to get bigger still.

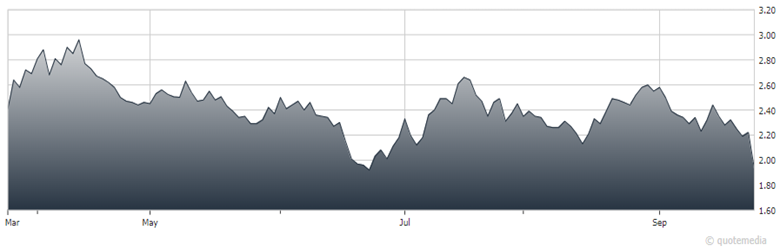

New Pacific Metals (NEWP)

While it’s difficult to put a value of this resource since we don’t know project building and operating/extraction costs, my guess is it’s a multiple of the company’s market cap of about CAD$500M. Yet the market yawned on this news and sold off gradually since.

Given the lower silver grades, I’d rather see this project potentially sold off at some point, so management can focus instead on the higher-grade Silver Sand project. Company founder and CEO, Dr. Rui Feng, stepped down as CEO, paving the way for Andrew Williams, formerly company President, to become the new CEO.

NEWP is quite underappreciated and attractive to accumulate on weakness.

Recommended Action: Buy NEWP.