Comcast (CMCSA) is the largest US cable system operator, with more than 34.3 million customer relationships as of December 31, 2022. Our “Buy” opinion partly reflects further upside on the valuation of the shares, with the integration of the cable, NBCU, and Sky businesses likely to enhance business and geographic diversification, writes Keith Snyder, analyst at CFRA Research.

The cable communications segment caters to residential (as well as business) customers; the media segment consists primarily of NBCUniversal’s television and streaming platforms; and the studios segment consists primarily of NBCUniversal’s film and television studio production and distribution operations.

We think Comcast’s results in 1H 2023 showed a firming recovery path for NBCU’s advertising, TV/film content, and theme parks businesses – benefiting from pent-up demand. Meanwhile, with the cable broadband business recently riding some demand tailwinds, CMCSA has increasingly pivoted to a broadband-led connectivity strategy and gained significant traction in its nascent wireless offering.

Comcast (CMCSA)

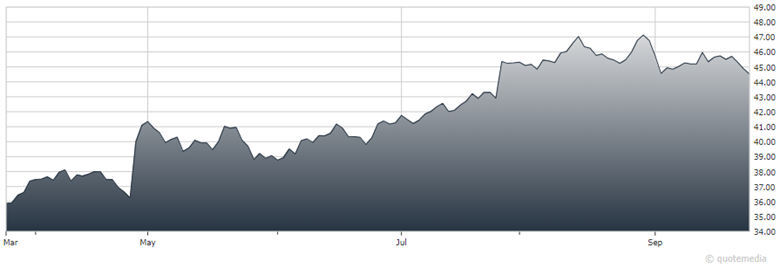

With likely sufficient financial flexibility, Comcast could sustain at least a high-single-digit return on invested capital (ROIC) in the years ahead, according to our analysis. Our 12-month target price is $50, with a total EV/EBITDA of 8.1x our 2023 estimate, roughly in line with peers. The stock recently offered a 2.6% dividend yield.

Risks to our opinion and target price include intensifying competition from over-the-top video platforms; regulatory risk factors (Net Neutrality, etc.); and currency exposure.

Recommended Action: Buy CMCSA.