Stocks have been struggling due to rising interest rates and some disappointing economic reports. Plus, with WTI Crude oil surging (and trading near $94 per barrel on Wednesday) inflation concerns have rekindled. But we expect the volatility to subside within the next few weeks, and new buying opportunities to emerge. One fund we like here is Dodge & Cox Global Stock Fund (DODWX), says Rosario “Sal” Salamone, contributing editor of MoneyLetter.

It may take several weeks. But based on analysis we’ve seen we expect oil and gasoline prices to moderate as we move away from the summer driving season. We will be keeping a close eye on upcoming economic reports; they have been a mixed bag over the last several days.

It may take several weeks. But based on analysis we’ve seen we expect oil and gasoline prices to moderate as we move away from the summer driving season. We will be keeping a close eye on upcoming economic reports; they have been a mixed bag over the last several days.

Returns for our four global indices have been mostly negative since the last Hotline, reflecting the prevailing economic and inflation concerns. For the reporting period, the S&P 500 was down 2.9% (September 21 – September 27); the Euro Stoxx 50 dropped 3.4%; the Nikkei 225 declined 2.0%; the Shanghai Composite was virtually unchanged.

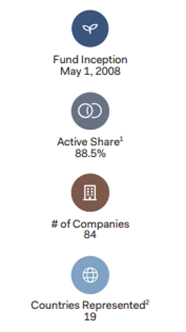

But keep in mind that September, historically, has been a weak month for stocks. For domestic stock funds there are no new Buys this week. But for international stock funds, there are three new Buys this week, one of which is DODWX.

Recommended Action: Buy DODWX.