Antici…pation. That seems to be where the stock market is right now. Not a lot is happening, but soon a lot will happen. Tech earnings are just around the corner, which should help reveal whether the Magnificent Seven mega-cap tech stocks are worth their current prices. Meanwhile, I like Gates Industrial Corp. (GTES), writes Bruce Kaser, editor of Cabot Value Investor.

Broadly, investors of all types wonder how consumer and industrial goods producers will fare, given rising pressures from inflation, inventory de-stocking, global outlook worries, and student loan repayments. Bank investors await results to glean whether we are headed into a second round of deposit runs.

Stocks are not cheap, especially in a world of 5%-6% Treasury yields. But how much, if at all, will this matter?

Macro forecasters also carry widely differing opinions on what kind, if any, of a landing is ahead for our economy. Will the statistically healthy economy remain robust, or will the 5+% of the economy that is solely supported by federal deficit spending, and geared toward a narrow roster of recipients, lead to wider deceleration?

Inflation reports are ahead, as are Fed meetings, an eventual new leadership in the House of Representatives and a possible government shutdown. Where are oil prices headed? Gold? We are in an information dead zone for now.

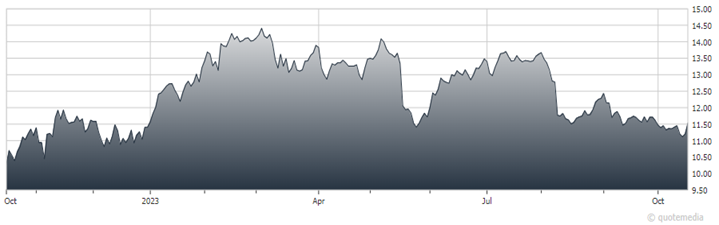

Gates Industrial Corp. (GTES)

As for GTES, it is a specialized producer of industrial drive belts and tubing. While this niche might sound unimpressive, Gates has become a leading global manufacturer by producing premium and innovative products. Its customers depend on heavy-duty vehicles, robots, production and warehouse machines, and other equipment to operate without fail, so the belts and hydraulic tubing that power these must be exceptionally reliable.

Few buyers would balk at a reasonable price premium on a small-priced part from Gates if it means their million-dollar equipment keeps running. Even in automobiles, which comprise roughly 43% of its revenues, Gates’ belts are nearly industry-standard for their reliability and value. Helping provide revenue stability, over 60% of its sales are for replacements.

Gates is well-positioned to prosper in an electric vehicle world, as its average content per EV, which require water pumps and other thermal management components for the battery and inverters, is likely to be considerably higher than its average content per gas-powered vehicle. The company produces wide EBITDA margins, has a reasonable debt balance, and generates considerable free cash flow. The management is high-quality.

In 2014, private equity firm Blackstone acquired Gates and significantly improved its product line-up and quality, operating efficiency, culture, and financial performance. Gates completed its IPO in 2018. Following several sell-downs, Blackstone has a 43% stake today.

Recommended Action: Buy GTES.