Uranium and nuclear power are still on the menu for investors. Clean and green, nuclear power has come back into the global spotlight in recent months as an attractive alternative to fossil fuels and as the Russia-Ukraine conflict has prompted governments to prioritize energy security. This renewed interest in nuclear has increased demand for uranium, and one way to play it is to buy the VanEck Uranium+Nuclear Energy ETF (NLR), writes Jim Woods, editor of The Deep Woods.

Uranium is the fuel for nuclear fission, the process through which nuclear energy — mostly electricity — is produced. Nuclear is back in vogue for the first time since the 2011 Fukushima disaster that prompted a stall in new production for over a decade.

While uranium is not a rare element, government investment in it has been low for years, negatively affecting the number of companies engaged in mining and exploration of the chemical element. But demand is now soaring in this niche industry and nuclear is on the rise.

The market is limited to just a few baskets of stocks from which to choose. Many have been seeing significant growth due to recent geopolitical events and a global focus on green climate policies. Uranium is vital to the green energy transition and increased demand has pushed uranium prices to their highest point since 2011.

As for NLR, it’s an ETF that targets companies across the uranium and nuclear energy industry. The portfolio focuses on companies expected to generate at least 50% of revenue or assets from mining, building, and maintaining nuclear facilities, producing electricity using nuclear sources, or providing services to the nuclear power industry.

VanEck’s NLR is smaller than other uranium ETFs and employs a different strategy. Unlike the Global X Uranium ETF (URA) and Sprott Uranium Miners ETF (URNM), NLR’s portfolio includes a hefty percentage of holdings in utilities. This makes it less of a pure-play option than the others and not quite as promising.

Its growth has not matched URA and URNM, but investing so heavily in nuclear power utilities helps to stabilize the portfolio in a highly volatile market. It also provides a modest recent yield of 1.57%.

NLR has 28 positions, and its top 10 holdings account for 59.6% of assets. The fund’s sector weighting favors Energy at 47.6% and Utilities at 40.6% of the portfolio, rounded out by Industrials at 10% and Information Technology at 1.5%.

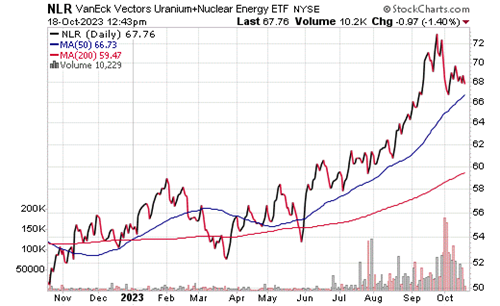

The fund was recently down 2.81% over the past month, but up 13.9% over the last three months and 25.2% year to date. NLR has a net asset value of $114.46 million and a net expense ratio of 0.61%.

Recommended Action: Buy NLR.