Plains GP Holdings (PAGP) shares give us an investment in a high-quality MLP without dealing with a Schedule K-1 at tax reporting time. In March 2020, I dropped PAGP from the recommendations list when the company cut its quarterly distribution by 50%. But the current underlying operating company is a much leaner, high-cash flow one compared to 2019, counsels Tim Plaehn, editor of The Dividend Hunter.

Each PAGP share is backed by one Plains All American Pipeline LP (PAA) unit. PAA is a Schedule K-1 reporting MLP. PAGP lets us have an equivalent investment that reports tax information on a Form 1099.

PAA is the operating company. Our PAGP shares completely match PAA, including dividend rates. We can look at the PAA financial reports to understand both PAA and PAGP.

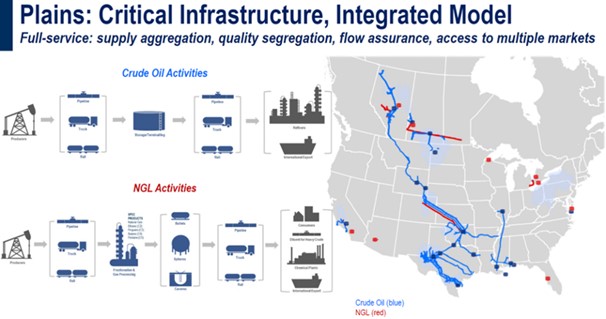

Plains All American operates primarily as a crude oil pipeline and storage midstream company. The company owns 18,000 miles of oil pipelines and 110 million barrels of storage capacity. Plains owns significant crude oil pipeline capacity out of the prolific Permian Basin.

Plains also operates significant natural gas liquids (NGLs) midstream assets. The assets include 200,000 barrels per day of fractionation capacity, 30 million barrels of storage, and 3,900 NGL railcars.

For 2018 through 2020, Plains embarked on massive capital spending, investing $1.38 billion. For 2023, investment spending is expected to total $325 million. Because of the significant asset build-out in those earlier years, the current more-modest level of investment will allow the company to continue to increase capacity, utilization, revenue, and profits.

Free cash flow for this year will come in at about $1.6 billion. Common unit dividends require a cash flow of about $750 million, giving current free cash flow coverage of 2.13 to one. Plains expects to pay down $1.0 billion of debt this year, reducing interest expense and increasing its free cash flow.

After two years of paying the same dividend rate, in 2022, Plains increased its dividend by 21%. For 2023, the annual dividend was increased by $0.20 (23% increase). Earlier this year, Plains management announced targeted annual dividend growth of $0.15 per share until cash flow coverage of 160% is reached. This policy means that we will see double-digit dividend growth until the rate is nearly double the current payout.

Recommended Action: Buy PAGP.