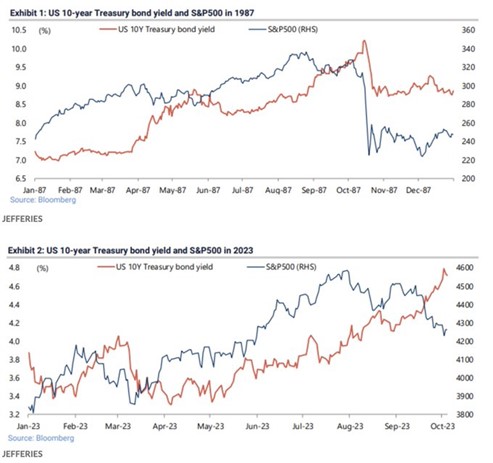

This week, the Wall Street Journal published an article entitled “Another Black Monday May Be Around the Corner.” Fortunately, they wrote it this Sunday (22nd) and it (Black Monday) didn’t take place on Monday (23rd), notes Tom Hayes, editor of Hedge Fund Tips.

Unlike Paul Tudor Jones who called it “Black Monday” the Friday (Oct. 16th) before it actually occurred in 1987 (Oct. 19th), these two academics lack the market understanding for a repeat. They are running out of October Mondays. Here’s what the nervous Nellies are focused on:

They point to the fact that because M2 Money Supply has contracted on a YOY basis, we are in “real danger.” Unfortunately, this is the intellectual equivalent of focusing exclusively on the liabilities in a balance sheet and not the assets.

They go on to say: “Because of the sustained decline in the money supply, the economy is in real danger. So far, only the remaining excess money the Fed created between 2020 and 2021—the cumulative excess savings from the Covid handouts—has been keeping businesses hiring and consumers spending. The effects of the excess money are still giving the economy a lift, but that extra fuel is almost exhausted. When it dries up, the economy will run on fumes.”

What they fail to acknowledge is there are $4 TRILLION of excess “fumes” from an unprecedented increase in Money Supply – due to an unprecedented shutdown in the global economy in 2020-2021. I drew “trend lines” so you can see just how wildly “above trend” we are:

In other words, money supply will have to contract for multiple years just to come back to the long-term uptrend. This is one of the reasons we believe inflation should run above trend (in a reasonable range of 3-5%) for a few years.

Like losing weight, there is an equation. The “easier” the loss (pill or needle), the greater the chance of impermanence or side effects. The “harder” the loss (healthy eating and lifestyle), the greater the chance of sustainability and improved health.

We had “easy” printed money for a few years, now we are getting involuntarily taxed (through inflation) in arrears (at the checkout counter) for that benefit received. Every equation has an equal sign. If you want greater returns over the long term, you have to assume greater concentration and volatility in the short term. Anyone who tells you otherwise, run away.

The key way to sit with equanimity when others are selling in the hole and running for the hills is to look at each BUSINESS you own. Not stock. BUSINESS. Ask yourself the following question for each company:

“If I owned this business in a private equity portfolio, is there anything that has changed about the business operations or ability to generate cashflow over the long term, that would require me to mark the value of the business DOWN in the portfolio?”

If your answer was, “Someone sent me a chart of 1987 and I’m scared,” that is not the correct answer and you should find another hobby.

After reviewing the comprehensive data, the only thing I can suggest is to follow Wilson Phillips’ profound advice from their 1990 hit “Hold On:”

Don’t you know?

Don’t you know things can change?

Things’ll go your way

If you hold on for one more day

Can you hold on for one more day?

Things’ll go your way

Hold on for one more day…