US stocks continued to wilt under pressure earlier this week as a miss for Alphabet’s (GOOGL) cloud business contributed to big tech declines. But overall earnings have been pretty good so far with 78% of reporting companies exceeding expectations. For international stock funds, there is one new “Buy” this week: T. Rowe Price Global Stock Fund (PRGSX), writes Brian Kelly, editor of Money Letter.

Higher bond yields, including the 10-year Treasury which climbed 11 basis points on Wednesday and traded over 5% earlier in the week, have been a big problem for stocks.

Returns for our four global indices have all been negative since the last Hotline amid rising interest rates. For the reporting period, the S&P 500 was down 3.0% (October 19 – October 25); the Euro Stoxx 50 dropped 0.2%; the Nikkei 225 declined 2.4%; the Shanghai Composite declined 2.8%.

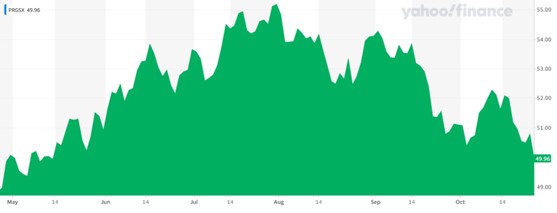

T. Rowe Price Global Stock Fund (PRGSX)

US stocks have been declining for three primary reasons: A government dominated by disorder, geopolitical instability, and most of all, rising interest rates. Although each of these factors has had a role in pressuring stock prices at different times since August, we consider them to be temporary and not fundamental in nature.

Risks, especially with two wars raging, are not to be ignored. But as we saw Wednesday afternoon with the election of a new House Speaker, these situations do have a path for improvement. Maintain your asset allocations.

Recommended Action: Buy PRGSX.