In 2023, investors have fled some sectors and industries because their results are sensitive to inflation and rapidly rising interest rates. They also fear a recession. However, recession has yet to occur, and stocks like Verizon Communications (VZ) remain attractive, writes Prakash Kolli, editor of Dividend Power.

Some equities are mispriced. For instance, VZ is one high-yield, long-term income stock that may generate decent total returns. Yes, it faces intense competition, causing problems with consumer retail cellular phone growth. The firm has experienced several quarters of flat or declining numbers in the business.

Besides competition, the firm’s Consumer Group has also been through two leaders in twelve months, probably creating turmoil and uncertainty. Another negative is that pre-paid phone numbers are falling, too.

But on the plus side, Verizon is still adding post-paid mobile subscribers because growth in business cellular phone users is more than compensating for the decline on the retail side. In addition, broadband is a success story for the communication giant with consistent growth.

For instance, in the second quarter of 2023, Verizon added 418,000 customers, divided between 354,000 fixed wireless access and 54,000 FiOS connections. Verizon is adding employees to continue its success in this area.

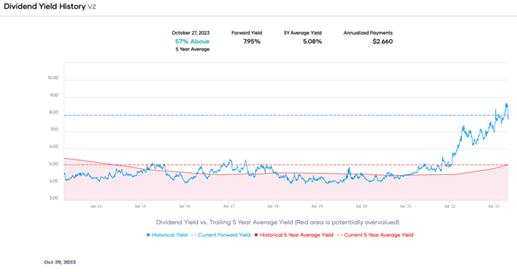

The telecommunications firm has an 8%+ dividend yield, the highest in at least ten years. Furthermore, the dividend rate has been increased for 19 consecutive years, giving it Dividend Contender status.

However, despite the elevated yield, Verizon’s dividend safety is not compromised with a non-GAAP payout ratio of 53% and lower-medium investment grade credit ratings of BBB+/Baa1. Also, the dividend quality grade is rock solid at an ‘A,’ meaning it is in the 90th percentile.

Despite the near-term challenges, Verizon has remained solidly profitable. It is undervalued, trading at a 6.8X earnings multiple. We view Verizon as a long-term buy, and investors may desire to dip into this stock now.

Recommended Action: Buy VZ.