Our view is the surge in uranium prices over the past few years represents the start of a third major bull market. Investors looking to beef up their exposure to the theme could consider three ETFs tracking the industry, one of which is the Global X Uranium ETF (URA) with total assets of about $2.3 billion, explains Elliott Gue, editor of Energy and Income Advisor.

Historically, we are NOT fans of exchange traded funds (ETFs) as a means to play long-term upside in energy stocks for the simple reason the energy sector historically rewards careful stock selection. After all, just look at the wide gaps in performance in energy stocks, even in closely related sub-sectors, over time and you’ll see the industry is comprised by “haves” and “have-nots.”

So, when you buy an ETF, you’re left holding a mixture of the good, the bad, and the downright ugly in the industry with corresponding mediocre returns. That said, one problem for uranium investors is the lack of investable names to gain exposure to the future growth prospects for nuclear power.

Unfortunately, that’s particularly true for US-based investors. For example, while ETFs designed to hold physical uranium exist in Canada and London, the SEC rejected an application for a similar ETF in the US. Many of the smaller miners around the world are also listed abroad – places like Canada, UK, and Australia – with only illiquid ADRs or “pink sheets” listing in the US.

For example, while ETFs designed to hold physical uranium exist in Canada and London, the SEC rejected an application for a similar ETF in the US. Many of the smaller miners around the world are also listed abroad – places like Canada, UK, and Australia – with only illiquid ADRs or “pink sheets” listing in the US.

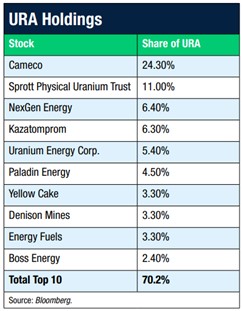

As you can see from this table, more than a third of URA is invested in Cameco and the Sprott Physical Uranium Trust. The former is one of the biggest uranium producers, while the latter is a Toronto-traded trust that’s designed to track the price of uranium.

The trust has no mining operations, it simply buys, stores, and holds physical uranium. You can buy it directly in Toronto under the symbol “U-U.”

We also recently covered Kazatomprom, the Kazakhstan producer of uranium, which is harder for US-based investors to buy. NexGen Energy, Uranium Energy Cop., Paladin, and Denison are all either uranium exploration companies or small producers. Yellow Cake is a London-based fund similar to the Sprott Physical Uranium Trust in Canada.

Our attitude with smaller producers, and particularly uranium exploration companies, is that many will never earn a dime and the stocks may ultimately prove worthless. Others could become producers and generate huge gains for investors or simply be acquired by a big name like Cameco to beef up output.

All in all, when attempting to gain exposure to a theme in a riskier group of stocks, a small position in an ETF can make sense because it diversifies your exposure to these riskier names.

Recommended Action: Buy URA