Gold buying in China, the world’s biggest gold market, is picking up speed. The US is on a crash course with a budget crisis in November. And that big gold cycle I keep talking about is pointing higher. Wheaton Precious Metals (WPM) is a great way to play a precious metals rally, maintains Sean Brodrick, editor of Resource Trader.

WPM has a market cap of around $19.7 billion. It has streaming agreements for 21 operating mines. It also has 14 development-stage projects, including a silver stream it just acquired for $115 million from Waterton Copper’s Mineral Park mine in Arizona. That mine should go into production in Q1 2025.

Being a streamer, Wheaton hires no miners and pays no fuel bills. So, its average cost is $422 per gold equivalent ounce (GEO). The company had $829 million in cash at the end of last quarter, and no debt.

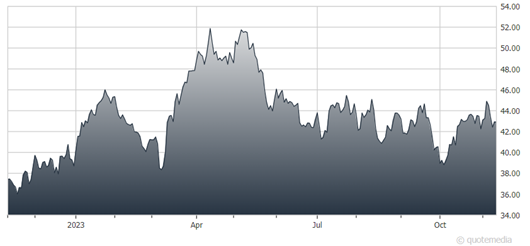

Wheaton Precious Metals (WPM)

A big worry hanging over Wheaton was the ongoing strike at Newmont (NEM)’s massive Peñasquito Mine. However, the strike ended Oct. 5. That strike, which started in June, will still weigh on Wheaton’s results for a bit. But now the weight has been lifted off future quarters, and I expect that to be reflected in the company’s forecast.

And looking down the road, Wheaton has two massive streaming assets set to head into commercial production by 2025. These assets are both in mining-friendly Canada. The Blackwater Mine in Central British Columbia should have its first gold and silver pour in H2 2024. The Goose Mine in Nunavut, Canada, should pour its first gold in early 2025.

One last reason I like Wheaton is it has a boatload of cash. So, it can self-finance any new stream acquisitions it does. This keeps it safe from the high interest rates that are ruining the outlook for other companies.

Recommended Action: Buy WPM.