Founded in 2002, Five Below (FIVE) is the leading high-growth value retailer marketing merchandise generally priced $5 or less to teens and tweens. The company also ends up selling to Generation Z’s parents. The average customer household income is approximately $75,000, with 14% having incomes over $100,000, recounts Doug Gerlach, editor of Investor Advisory Service.

The beauty of Five Below’s merchandise strategy is that teens and tweens have disposable income because their basic needs are met by their parents and goods $5 or less are easily affordable. To keep customers interested in visiting stores, the company offers a dynamic assortment of products.

Each store sells merchandise in eight “Worlds”: Sports, Tech, Create, Party, Candy, Room, Style, and New & Now. These worlds enable tremendous flexibility in product offering, allowing for a continually refreshed assortment that can capitalize on trends and incentivize return visits. The company closely monitors trends and has demonstrated it can quickly identify and respond to trends that become mainstream.

This has been evident in recent years with fidget spinners, Squishmallows, and sensory toys like poppers. In 2022, the company’s overall sales breakdown was 48% from leisure products, 29% from fashion and home, and the balance from snack and seasonal products.

Stores average approximately 9,500 square feet and generate first full year sales of about $2.2 million. For a net investment of about $400,000, the first year EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization, a measure of cash flow) of a new store is $550,000, a 138% return on investment and an average payback period of less than one year on initial investment. We rarely see this kind of rapid payback on invested capital.

Five Below has been a public company since 2012. Even so, the company is relatively early in its growth phase. It operates more than 1,400 stores across 43 states. Management believes it can grow its base to more than 3,500 U.S. stores by 2030. Growth in comparable store sales should add to that from new stores.

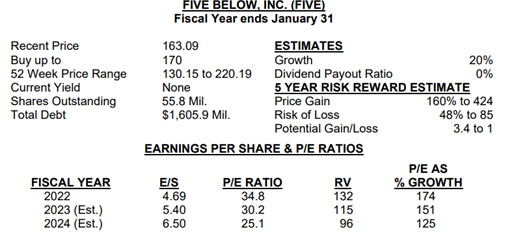

At its investor day in March 2022, the company introduced its “Triple-Double” growth vision. This included plans to triple its store base to more than 3,500 stores by 2030, as well as double its sales to $5.6 billion and more than double earnings to $10 per share by 2025. We anticipate Five Below can grow its EPS 20% per year. A combination of at least mid-teens unit growth, low-single digit comparable sales growth, and modest leverage are the drivers.

Recommended Action: Buy FIVE.