Will "higher for longer" interest rates derail utilities’ inflation-beating dividend growth? The Dow Jones Utility Average’s total return is 27 percentage points behind the S&P 500’s so far in 2023, a wider gap than in 1999. So obviously, the Wall Street consensus has been yes. But reality says different, which is one reason why I still like Dominion Energy (D), says Roger Conrad, editor of Conrad’s Utility Investor.

In fact, no fewer than 48 of the 172 companies in my Utility Report Card coverage universe raised their 2023 guidance after releasing Q3 results. A third that many reduced guidance, but none cited higher interest rates as a primary reason.

Evergy (EVRG) cut the mid-point of its annual target growth range from 7 percent to 5 percent. But every other company in the coverage universe affirmed previous projections. Several announced meaningful capital spending increases. And Northwestern Energy Group (NWE) increased projected long-term growth following a favorable rate settlement in Montana.

If companies maintain guidance, investors can be assured of a massive re-rating to higher prices for sector stocks. Plus, US regulation is supportive as ever against the negative impact of rising interest rates. Even Evergy’s retrenchment may reverse if Kansas regulators approve a rate settlement in a ruling expected by Dec. 21.

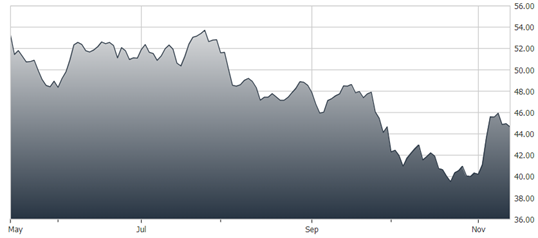

Dominion Energy (D)

If companies do falter, we’re going to want to move on. But with virtually all numbers and guidance updates in, the earnings Armageddon so many seemed to take for granted a month ago simply hasn’t happened. Nor is there any real indication it will, other than for a handful of particularly challenged companies.

That makes now a great time to incrementally build positions, with the best fresh money buys my focus stocks. This month’s top pick for the conservative is long-time holding Dominion, which not only pays a great dividend but is poised for big gains as it concludes a year-long strategic review on far better than expected terms.

Recommended Action: Buy D.