“Next Thing You Know” is a song co-written and recorded by American country music singer Jordan Davis. I chose this song as the theme for this article because the lifetime progression he outlines in the song reminds me of when you apply a disciplined proven framework to your investing process and then you WAIT and let it play out as it always does. Sometimes sooner, sometimes later, but it always works over time when the framework is correct, says Tom Hayes, editor of Hedge Fund Tips.

As I’ve stated many times, when it comes, it comes all at once. All you can control is the process – not the timeline. Some investments reach intrinsic value in six months and some take 36-plus. The key is buying durable, proven, cash-generative businesses when they are temporarily impaired and then sitting on your hands until they are fully valued.

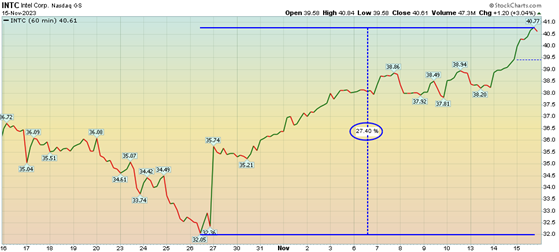

Here is just one of the positions/ideas we have discussed in on our weekly podcasts and in public media appearances – Intel (INTC). You can see how it has performed of late:

The best part is, as much as it’s been nice to see these names move aggressively in the last few weeks, NOT ONE OF THEM IS NEAR OUR PRE-DETERMINED TARGET OF INTRINSIC VALUE.

“Every battle is won or lost before it is ever fought” – Sun Tzu – The Art of War. In other words, most of these names are JUST GETTING GOING and still have many more months or years of runway before reaching fully valued status (and are sold). If you think you “missed it” you’re mistaken. The majority of these have just started leaving the station.

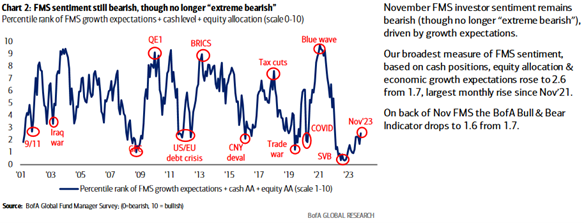

Meanwhile, Bank of America recently published its monthly “Fund Manager Survey.” Here are the 3 key points:

1. Managers are still more pessimistic than they were at the March 2020 Pandemic Lows and March 2009 Great Financial Crisis lows. Markets will continue to climb the “Wall of Worry” until these managers are forced back in against their will. Always remember, “opinion follows trend.” As price moves up and they are pushed back in, they will be just as confident in their new bullish thesis as they currently are with their bearish one:

2. Managers love T-Bills and Cash. They hate Emerging Markets, China, REITs, UK, and Banks. Take the other side.

3. Managers are STARTING to come out of cash as the markets get away from them, but they are still too underweight risk assets and will have to chase.