Two decades ago, three friends were working at legacy computer networking companies. They had an idea that could radically disrupt the entire sector by turning expensive hardware into software. This low-end disruption model would drive down costs and force the legacy companies they worked for to move upstream to protect profit margins. This is the tale of Arista Networks (ANET), writes Jon Markman, editor of Disruptors & Dominators.

ANET began in 2004 when Andy Bechtolsheim, David Cheriton, and Kenneth Duda – a trio, who had worked together at Cisco Systems (CSCO) and Sun Microsystems – thought they could use software to dramatically increase the efficiency of network switches and routers. Their new Extensible Operating System – a scalable, open software framework – made dumb switches smart. EOS also moved everything to the cloud, a novel concept two decades ago.

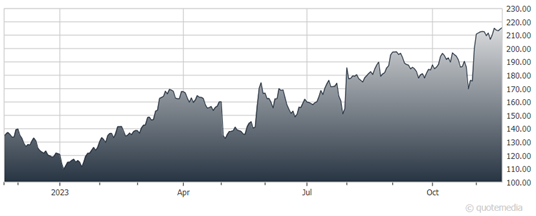

Arista Networks (ANET)

EOS is completely programmatic. It gives data center clients greater control over how the network performs. Routing, tracers, software development kits, security, and other key parts of the network are treated as modular pieces. They can be added, upgraded, or even removed without disrupting the entire network. The network is software defined.

“Software defined networks,” or SDNs, are the only really big innovation to hit computer networking in two decades. And they are extremely inexpensive to run. A Barron’s report in 2017 found that the operational cost per 100GbE port was about $3,000. The comparable cost for a Cisco solution then was $100,000.

Also, the Arista solution is fast. That’s because EOS was built for speed. In its infancy, Arista executives bypassed propriety hardware-plus-software stacks so they could focus purely on software development. They wanted to build a system that appealed to the data center hyperscalers. So, they focused on decentralized, open structure, modular and high-speed switches of 100 gigabits or more, resulting in rapid market share growth.

Arista holds roughly a third of the 100-gigabit port or faster market, surpassing Cisco. Arista is also tops in market share for 100-gig and 400-gig ports, a key metric for the fastest networks.

Normally, the lowest-cost, highest-speed option wins in tech. That hasn’t been the case in networking. Arista is still nowhere near the biggest player in the sandbox. That distinction clearly belongs to Cisco Systems. However, Arista is the fastest growing company in this niche by a long shot. It is also dominating in the cloud…the best part of the network switching business.

Artificial intelligence (AI) is going to play a much larger role moving forward, too. Most of the corporate world is moving to cloud-based workloads that are enhanced by AI. Large language models such as ChatGPT require massive brute force computing, and faster networking helps.

Recommended Action: Buy ANET.