Winter has officially pushed its way into our little world on the farm. The mornings are bitter. The temperatures are at or below freezing. The dogs have donned their sweaters (they’re bully mixes, the only thing they hate more than water is cold). Now, we dive into arguably the most important month for the markets of the year – December, writes Matthew Carr, editor of Tipping Point Profits.

First, as expected, November didn't wind to a close with despair… but celebration. The Invesco QQQ ETF (QQQ) – the proxy for the Nasdaq 100 – exited the month with a double-digit gain after setting a new 52-week high. Not only that, but the tech heavyweights ended November with a gain for the eleventh time in the last 12 years.

But December can be a tricky month for the markets. I tend to think of it as a moody, delicate one.

With holiday spending a vital catalyst – a make-or-break moment for many a retailer – there are typically headlines as we race toward the big days that holiday spending will fall short. Though, we already know that it’s off to a record-breaking start.

Americans dropped a record $9.8 billion on Black Friday. That was an increase of 7.5% from 2022. But the spending spree didn’t end there. On Cyber Monday, consumers shoveled out a record $12.4 billion. And during the stretch from 10:00 AM to 11:00 AM EST rang the digital register at $15.7 million per minute.

When all was said and done, for Cyber Week, Americans spent $38 billion, up 7.8% from a year ago. And one of the most important takeaways was foot traffic in stores increased a mere 2%...Meanwhile, smartphones accounted for 51.8% of all sales.

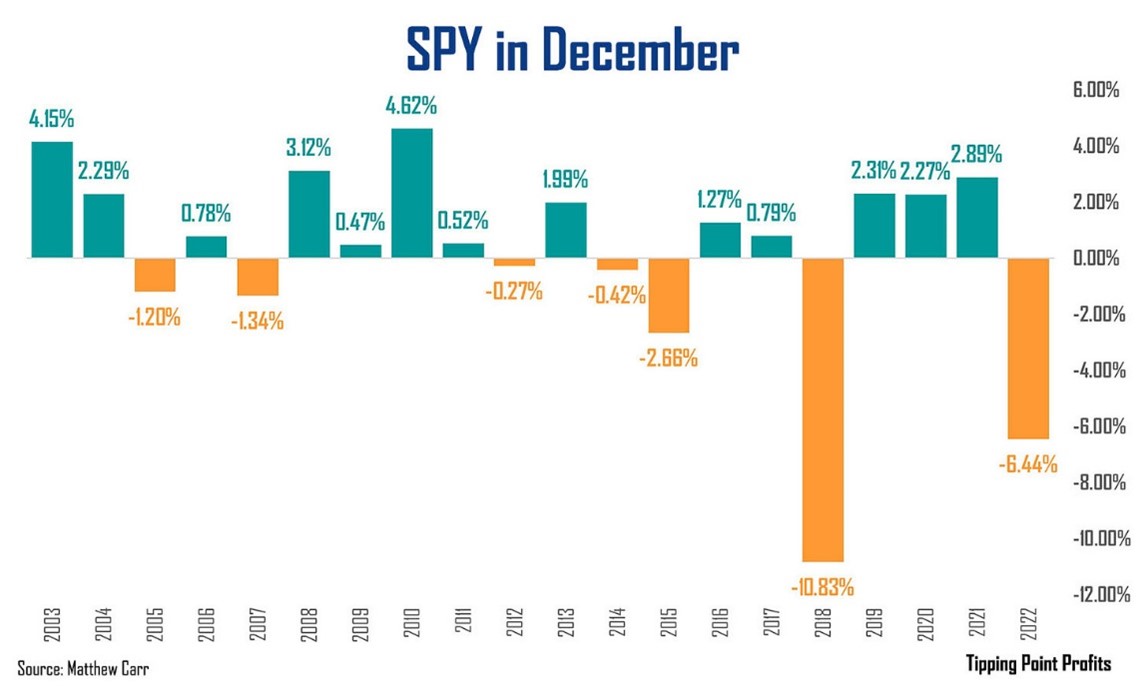

Encouraging. As for the SPDR S&P 500 ETF (SPY), it has averaged a gain of 0.22% in December. That may not seem like much. But that’s a better performance than January, February, June, August, or September. It ranks as the seventh-best month for blue chips.

Now, the most important aspect of this Christmas Carol is that unnerving swings lower by the S&P during December are rare. And the only real nightmares before Christmas over the last 20 years were the 6.44% drop in 2022 and the notoriously bad 10.83% decline in 2018, which included the worst Christmas Eve session on record.

All-in-all, this equates to a 65% chance of success for the S&P. For comparison, the average chance for a gain for the SPY in any given month during the past 20 years is 64.6%. So, that’s slightly better than average.

And though inflation is still not yet to the level the Federal Reserve would like, we’re not in the same situation in 2022 or mired in a trade war with China as in 2018.

More often than not, December has been a profitable gift for investors to close out the year whether you’re in blue chips or tech. So, don’t expect coal in your stocking this year.