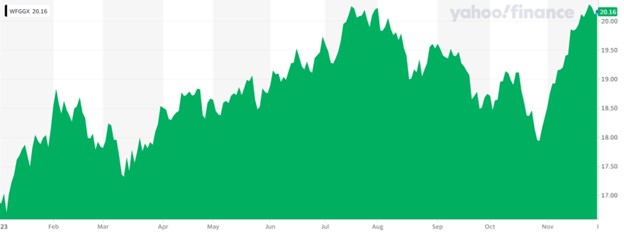

Our soft-landing thesis remains in place. Enjoy your November gains. Maintain your asset allocations. And for international stock funds, a new Buy this week is WCM Focused Global Growth (WFGGX), suggests Brian Kelly, editor of Money Letter.

US stocks were little changed on Wednesday, preserving what looks to be a very strong month of November for equity investors. Supporting prices was the 10-year Treasury note, which saw its yield fall below 4.3% for the first time since September.

Just as higher Treasury yields helped drive the benchmark S&P 500 from about 4,600 in August down to nearly 4,100 on October 27, the opposite effect has occurred in November.

Returns for our four global indices have been mostly negative, but only slightly so since the last Hotline. For the reporting period, the S&P 500 was off by 0.1% (November 23 – November 29); the Euro Stoxx 50 was ahead 0.4%; the Nikkei 225 declined 0.4%; the Shanghai Composite dropped 0.7%.

WCM Focused Global Growth (WFGGX)

For the year-to-date, the S500 is up 18.5%, the E50 is up 15.2%, the N225 is up 27.7%, and the Shanghai Composite is the lone decliner at -0.7%.

Despite the revised 3rd Quarter GDP of +5.2%, all eyes are on current and upcoming economic reports. It appears clear that a period of slowing is underway for the US economy. The open questions are how slow do we get, and will the Fed come to the rescue? Currently, we do not see cuts in the fed funds rate until late in 2024.

Recommended Action: Buy WFGGX.