America loves weight-loss drugs. Here, I’m talking about the newest class of weight-loss drugs, the “GLP-1 drugs.” Indeed, the long-term impact of GLP-1 drugs has been a significant story in markets throughout 2023, but lately it’s had a bigger macro impact. Novo Nordisk (NVO) is a clear beneficiary, writes Jim Woods, editor of The Deep Woods.

The reason these GLP-1 drugs have had such a varied and broad impact on different parts of the market can be summed up by this statement: There are expectations that these GLP-1 drugs could result in substantially less food consumption across the country in the coming years. They literally could reduce the demand for food!

So, what are GLP-1 drugs? The brand names of two of the most popular GLP-1 drugs are Ozempic and Wegovy (both produced by NVO). GLP-1 drugs were initially designed as diabetes drugs, as GLP-1 drugs stimulate the body to produce more insulin after someone has eaten. The extra insulin helps to reduce sugar levels and has proven very effective in controlling Type-2 diabetes.

But along the way, users of the drugs noticed a side effect: They weren’t as hungry and lost weight. Studies have found that using GLP-1 drugs can lead to 10-15 pounds of weight loss. Given that, these now are being marketed as weight loss drugs and their popularity has exploded.

Why has this impacted markets? In short, because a lot of people are starting to use them. In the second quarter, sales of Ozempic rose more than 50% from a year ago (from $2.1 billion in 2022 to $3.2 billion), while Wegovy sales rose 30% from 2022 (to $1.1 billion). That’s having a direct impact on two of the biggest pharma stocks that have “first mover advantage” in this space.

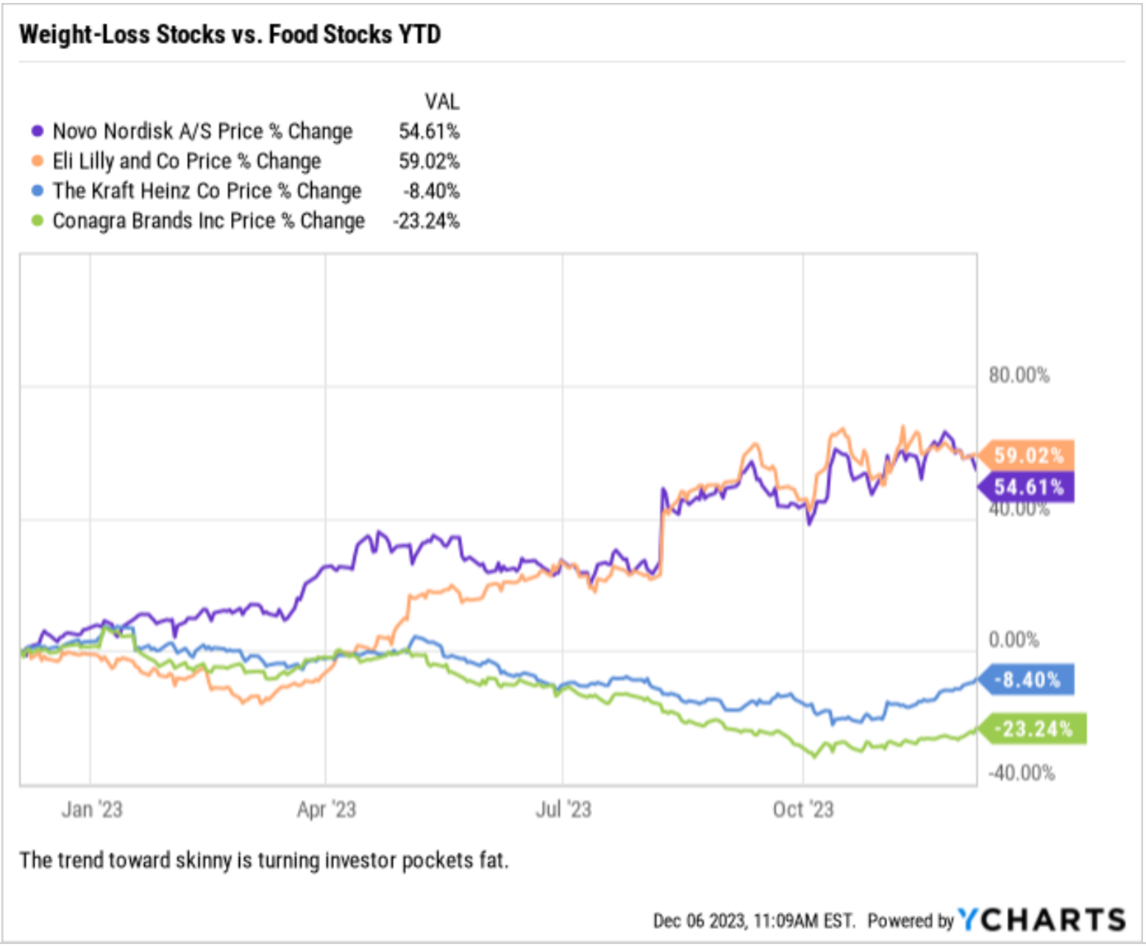

Novo Nordisk, who has two GLP-1 drugs (Ozempic and Wegovy), had recently risen 54.5% year to date (YTD). Eli Lilly (LLY), who manufactures Mounjaro, was up nearly 59% YTD (full disclosure, I am long both NVO and LLY in my newsletter advisory services). Conversely, pharma names that are not in this space have seen less-stellar returns. Merck (MRK) was down 5% YTD, while Pfizer (PFE) had collapsed 42%, in part due to falling Covid vaccine demand.

While certain pharma names have benefitted, a lot of processed food companies have seen their stocks fall sharply on concerns that, over the long term, widespread adoption of these GLP-1 drugs could structurally reduce demand for processed foods.

Companies such as Kraft (KHC), Conagra (CAG), and Mondelez (MDLZ) have lagged the S&P 500, and in the cases of Kraft and Conagra, posted substantially negative returns (down 8.5% and 23% YTD, respectively). The reasoning here is clear: Estimates for GLP-1 drug usage forecast 25-50 million users by 2030.

For targeted GLP-1 exposure, obviously buying NVO or LLY gets the job done. From an ETF standpoint, the VanEck Pharmaceutical ETF (PPH) (here again, we are long PPH in my newsletter advisory services) is a good choice as LLY is the largest holding (8.3%) while NVO is second at 6.5%.

Recommended Action: Buy NVO and PPH.