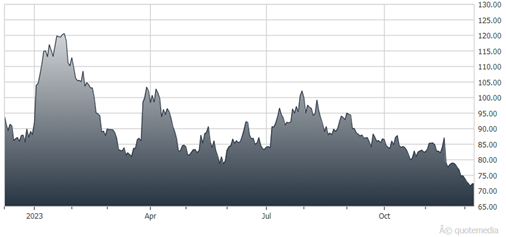

The business at Alibaba Group Holding (BABA) continues to improve and generate more free cash flow (27% growth YoY, $28.1B FCF TTM, 21.8% FCF yield) and higher sales (+9% YoY). The price of the stock does not reflect that – until it does, notes Tom Hayes, editor of Hedge Fund Tips.

There are ~$60-70B of non-core assets (everything that is NOT Taobao, Tmall, AliCloud, or AIDC) that we can expect will be monetized. Add the ~$60B of additional net cash on the balance sheet + $28.1B (TTM Free Cash Flow generation growing prospectively) and they will have enough cash to buy in 100% of the float.

If you don’t know what that means, let me put it this way: Say you own an apartment building with 10 partners. Then assume the cash that the asset generates is used to buy out your other nine partners’ equity (without you having to put in more of your own cash). Over time, you are the only shareholder left receiving the benefits of the asset/cash flow (if you are the patient partner who refuses to sell).

Alibaba Group Holding (BABA)

With that said, there is a whole bunch of noise circulating around how SoftBank pre-paid forward contracts are responsible for the price of BABA “being held down.” What I can tell you from being in this business for many years is this:

When price moves against you, it is always due to mysterious “manipulation” and never due to being early or wrong. When price moves with you, it’s always your “brilliance” that caused it. The only thing you can control is your PROCESS, not the timing.

We have had some multi-baggers hit “fair value” in months. Others take years. “Traders” say it is “wrong” or “early” – which is why there are very few of them on the Forbes 400. Good things come to those who wait (not whine).

Let me state this clearly from the masters Ben Graham (and Warren Buffett): In the SHORT TERM, the market is a VOTING MACHINE based on EMOTIONS. In the long term, it is a WEIGHING MACHINE based on FUNDAMENTALS. Whether it is “tax-loss selling”, “Soft-Bank”, “Jack Ma Selling”, or “Elliot Wave” silliness causing the price to move down, it is all NONSENSE.

At the end of the day, PRICE is only what you PAY, VALUE is what you GET. Is the business generating more free cash flow today than it was last year when it traded in the $60s-$70s, and in 2015 when it traded in the $60s-$70s? Are the free cash flow and revenues growing or contracting? Is the multiple/yield on that cashflow above your expected rate of return and is it trading above or below its historic range and that of comps? Everything else is a complete waste of time.

Right now, the PRICE is detached from the intrinsic value, but a beach ball can only be held under water for so long. Eventually, physics takes over.

Recommended Action: Buy BABA.