If you’re like me, you’ve had your fill of anything having to do with artificial intelligence, better known as AI. It's everywhere you turn – TV, radio, news articles, investment newsletters, and more. But if you’re looking for a “backdoor” way to profit from the trend, consider S&P Global (SPGI), suggests Herb Greenberg, editor of Herb Greenberg On the Street.

Not that AI hasn't been around for years...but the rollout of generative AI, with ChatGPT probably the best-known example, ignited interest and a euphoria not seen since the early days of the Internet. Before you say you don't want to hear another word about ChatGPT, let me assure you that's not what this is about.

Instead, data was top of mind during a recent discussion I was having with Matt Ober. (We were actually walking on a path alongside the Pacific Ocean in the San Diego beach town of Encinitas.) He’s a partner at Social Leverage, a VC firm that invests in tech startups. He knows a thing or two about data.

We first met a few years earlier when he was chief data scientist at the hedge fund, Third Point, which he had joined after being co-head of data strategy at WorldQuant. When our discussion rolled around to AI, he mentioned that he was actively looking for companies that will somehow springboard off of generative AI technologies.

That led to data, because one thing all of these companies will need, he said, is data. And not just any data, but the good stuff that's mostly behind paywalls. Extend that to investing, finance, and business in general – and we're talking a need for loads of data...loads of proprietary data.

That led to which companies are best positioned to benefit from the data they own. He mentioned a few, but at the top of the list coincidentally was a company that has for years been a top idea of another friend, who always says the same thing about it whenever we speak: “It’s such a great business.”

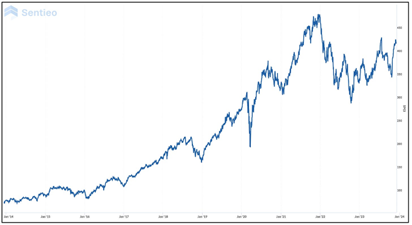

S&P Global (SPGI)

Lightbulbs went off, and I decided to dig in. That’s how I wound up writing about SPGI. You no doubt have heard of S&P. The company is best known for its Standard & Poor's credit ratings, as well as its stock indexes – notably, the S&P 500.

What you probably don't know is that S&P is also one of the largest providers of proprietary data – primarily financial, but also on the supply chain, transportation, commodities, environmental, weather, and much more.

No matter how it's spun, while it formally operates in the world of information services, S&P is a data company. It owns enormous amounts of valuable data, either outright or amalgamated, which have been turned into proprietary data sets that would be nearly impossible to easily replicate.

That makes it…a perfect backdoor play on AI.