In October, the markets were down 10% from the July high, bond yields were touching 5%, and talk of a coming recession was rampant. What happened? Since 2008, the Fed has trained investors. Any financial or recessionary event jeopardizing the markets would be met with rate cuts and accommodative policy, writes Lance Roberts, editor of Bull Bear Report.

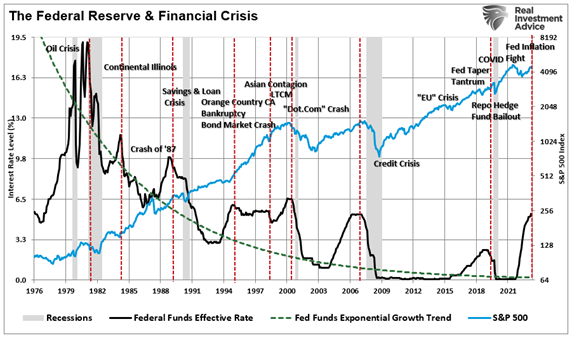

A Wall Street axiom says, “Sell the last Fed rate hike.” The reason is that when the Fed starts cutting rates, it is due to the onset of a recession, a bear market, or a financial event. At that point, as shown below, the markets are repricing for lower expectations of earnings growth rates and profitability.

And as Michael Lebowitz noted previously in Federal Reserve Pivots Are Not Bullish:

“Since 1970, there have been nine instances in which the Fed significantly cut the Fed Funds rate. The average maximum drawdown from the start of each rate reduction period to the market trough was 27.25%. The three most recent episodes saw larger-than-average drawdowns. Of the six other experiences, only one, 1974-1977, saw a drawdown worse than the average.”

Given that historical perspective, it certainly seems apparent that investors should NOT be anticipating a Fed rate-cutting cycle. Such should, in theory, coincide with the Fed working to counter a deflationary economic cycle or financial event.

Yet, since the beginning of November, the markets have risen sharply in anticipation of the Fed cutting rates as soon as the first quarter of 2024. More interestingly, the worse the economic data is, the more bullish investors have become looking for that policy reversal.

Before 2008, there was clear evidence that markets repriced lower when the Fed began a rate-cutting cycle. Such was because the realization of a financial event created selling pressure in the market. Stocks historically fell until that rate-cutting cycle was over and the catalyzing event was resolved.

But since 2008, markets have been trained to expect accommodation – and the training was completed with the Fed’s response to the “pandemic-era shutdown” that led to massive monetary and fiscal interventions.

There is currently a large contingent of investors who have never seen an actual bear market. For many investors in the markets today, their entire investing experience consists of continual interventions by the Federal Reserve. Therefore, it is unsurprising investors are fully trained to have “fear of missing out” regarding the next round of Fed support.

Using history as a guide, the many voices suggesting more bearish outcomes for 2024 seem logical. However, we must consider the impact of the Fed’s decade-long training of investors to “buy monetary policy changes.”

It may not make logical or fundamental sense. However, we must remain open to the possibility that markets are front-running the eventual Fed’s “ringing of the bell.”