When commodity prices decline as quickly as they did recently for whatever reason – in this case rising US inventories and fears about Chinese economic weakness – it’s all too easy to forget this long-term energy up-cycle is still in its very early innings. I like Baker Hughes (BKR) here, writes Elliott Gue, editor of Energy and Income Advisor.

In fact, it’s a safe bet the money that typically drives near-term market moves neither knows nor cares whether or not the underlying drivers of the cycle are still intact – as players chase the next shiny object.

They should be paying attention. The Q3 results and guidance updates we’ve seen in the sector show very clearly that the discipline of shale is strong as ever. That means investment and supply are still lagging long-term demand for energy, which means growing scarcity and rising prices in our future.

That’s how long-term energy cycles work. And the easiest way to take advantage is simply to build positions in the strongest companies over time, riding their share prices up to levels that will almost certainly exceed the highs of previous cycles – as we collect a rising stream of dividends off current yields higher than we’ve seen in any previous cycle.

Baker Hughes (BKR)

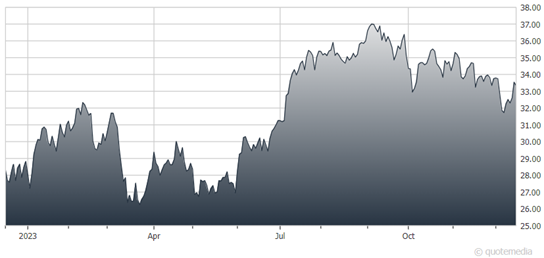

As for BKR, the global oilfield services company is sitting on a total return of 17.5 percent so far in 2023. Q3 results were quite strong, with orders and revenue up 40 percent and 24 percent, respectively. EBITDA advanced 30 percent from a year ago, pushing up free cash flow by 42 percent and earnings per share by 62 percent.

Management pointed to “positive momentum across our portfolio despite persisting global uncertainty” and some softness in the US rig count, which Baker’s global focus insulates it from. And it forecast “double-digit spending growth” for its customers in 2024, after raising its forecast for LNG equipment demand.

Recommended Action: Buy BKR.