The stock market recently made new all-time highs when the S&P 500 closed at 4,839.81. This was the first new high since the S&P closed at 4,796.56 on January 3, 2022. But believe it or not, the stock market has actually gotten cheaper over this time, notes Sam Ro, editor of TKer.

“While stock prices topped the prior peak set on January 3, 2022, forward earnings estimates are +9.9% higher and valuations are -8.2% (-1.8x multiple points) lower,” wrote UBS’s Jonathan Golub recently. “Importantly, 77% of S&P 500 companies trade at a discount to their January 2022 levels.”

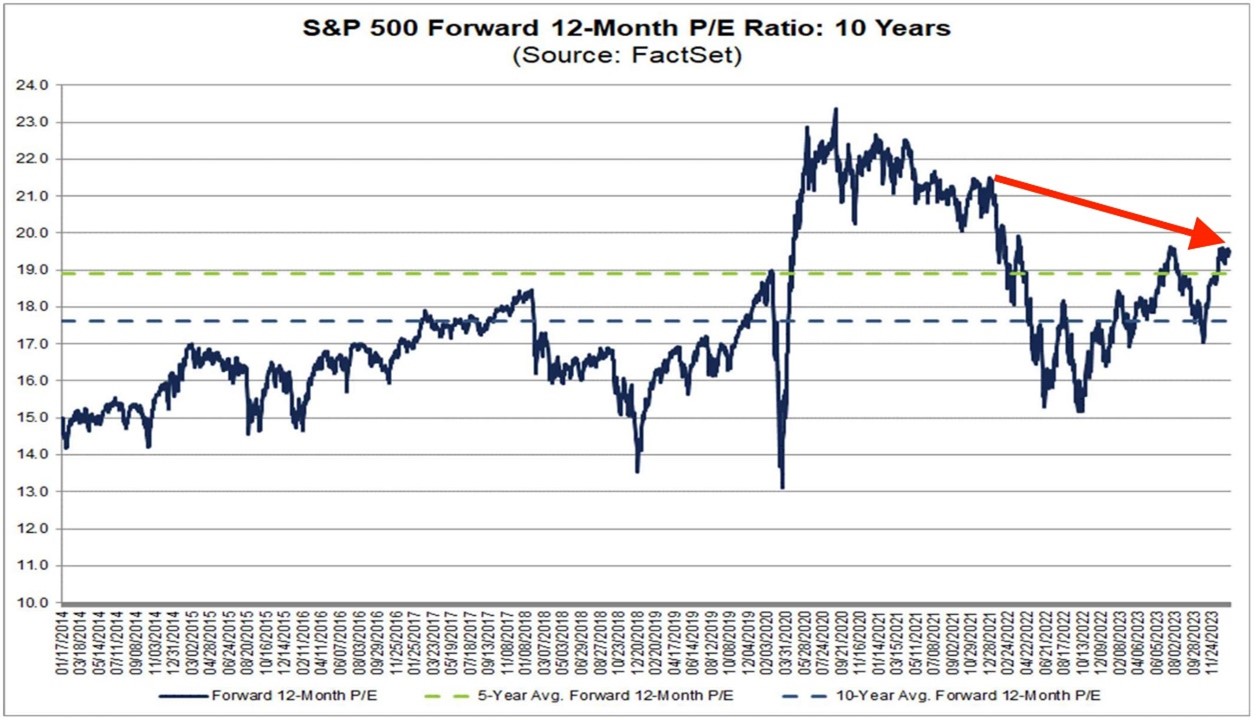

When Golub speaks of valuations, he’s referring to the forward price-to-earnings (P/E) ratio, calculated by taking the S&P 500’s current level and dividing it by the expected next 12 months’ earnings of those underlying S&P 500 companies.

If the forward P/E on the index is rising, then it’s considered more expensive. If it’s falling, then it’s considered cheaper.

What we’ve observed in P/E ratios is the latest reminder that prices don’t have to fall for the market to get cheaper.

Sure, prices can move much more quickly and more significantly over short time periods than analysts’ forecasts for the next 12 months’ earnings. But earnings tend to trend higher. That means as time passes, the forward “E” tends to move up, putting downward pressure on forward P/Es.

One of the most important ongoing discussions we have here at TKer is about valuations and how investors should think about them. Yes, valuations tell us something about value, and historically they’ve had some relationship with longer-term returns.

Unfortunately, they are not that helpful in understanding what markets will do over shorter periods of time. As we say in TKer Stock Market Truth No. 6: Valuations won’t tell you much about next year.

This is particularly relevant today. The S&P’s forward P/E is hovering above its five-year and 10-year historical averages. Indeed, coming into 2024, Wall Street strategists acknowledged valuations were above historical averages. But they were also split on whether this would prove to be a major headwind.

For now, the market appears unaffected by arguably elevated valuations. And the good news is, valuations are lower today than they were at the market’s January 2022 high.