Gold looks poised for a February bull run. We can point to the usual fundamental suspects of tight supply and safe-haven buying as the world goes to heck in a handcart. But for this bull run, I think gold miners should be sending “thank you” gift baskets to the Federal Reserve. So should investors in the SPDR Gold Shares (GLD), says Sean Brodrick, editor of Weiss Ratings Daily.

That’s because I believe the Fed is likely to cut interest rates at its upcoming March meeting. And that’s going to add to financial conditions that are already at their loosest in two years.

That may come as a shock because interest rates are high, right? But financial conditions are determined by a bunch of things: Corporate bond spreads, money supply, equity values, mortgage rates, the trade-weighted dollar, and energy prices.

That last one is important. Energy prices are way down, with natural gas prices scraping bottom and oil prices off a whopping 41% from their 2022 highs. Also, the market is anticipating Fed rate cuts. So, bond yields and mortgage rates have started to come down as well. The result? The Bloomberg Index of Financial Conditions is the most accommodative in two years.

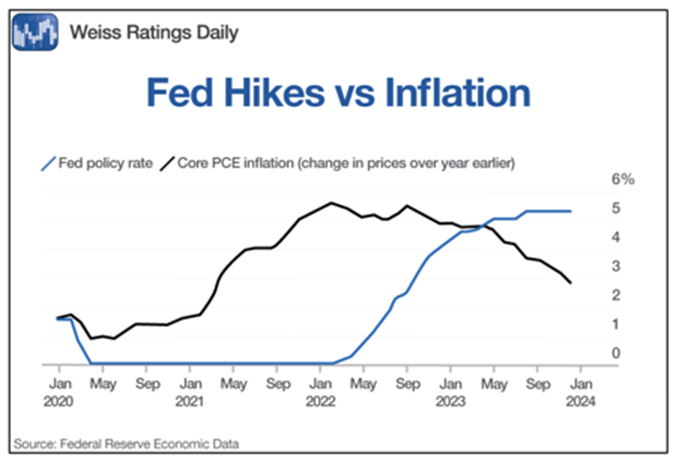

So, with financial conditions so loosey-goosey, why would the Federal Reserve cut at its March meeting? Because the painful rate hikes the Fed has already put in place have brought the core personal consumption expenditures (PCE) price index down to 2.9%.

The Core PCE is how the Fed benchmarks inflation. We’re getting close to “mission accomplished.”

Now, some people will say, “Hey, dummy! Inflation may be down, but prices are still up!” That’s true, but the Fed is solely focused on the rate of prices going higher, not on the fact that you’re paying more than you paid last year.

So, this, along with some other indicators, makes me believe the Fed will give us a rate cut in March.

And you know who else believes that? Gold traders.

Look at a chart of the GLD, an exchange-traded fund that holds physical gold and tracks the price movements in the yellow metal closely.

You can see that GLD has been coiling up for months. Now, though, it broke the recent downtrend. And this points to a short-term rally in gold of about 16%. That would bring gold to around $2,390 per ounce.

That’s short term. My long-term target on gold is much higher. The GLD is a perfectly fine way to play this rally. Or you could buy gold miners for more leverage to the metal. Either way, don’t miss this bull run. Gold is going to shine!

Recommended Action: Buy GLD.